MoneyMe provides you and the whole of Australia with an online credit card that is convenient and reliable. Use our credit card application now and say goodbye to those traditional plastic cards.

Can I cancel my credit card online?

After asking, ‘How to apply for a credit card?’ you may want to cancel it due to a number of reasons. You can choose to cancel your Freestyle Card account at any time. However, according to our terms and conditions, you must notify us through a written statement and pay off any outstanding balance.

It is also important to note that all your obligations, debt, and charges must be dealt with before the cancellation can be approved on our side.

Can I reduce my credit card limit online?

Don’t worry; you may choose to reduce the limit of your virtual credit card at any given time. Just notify us and keep in mind that the effects of your request are not instant. The act of reducing your credit limit may take some time to be processed depending on the influx of other requests and platform updates in MoneyMe. However, we assure you that we will attend to your concern as soon as procedurally possible.

How do I pay off my credit card online?

Paying off your credit card is essential as it does not function like online debit cards with money already loaded up inside. If you’re still unfamiliar with the differences, learn about credit card vs debit card on our site for more information.

n order to pay off the money you have been borrowing, simply check your payment schedule in the Members Area. If you wish to pay for your expenses now, click ‘Make a payment’ in the Account Overview section. Another way of doing this is by going through the main menu, clicking ‘Manage my loan’ and then ending the process with ‘Make a payment’.

How to buy things online without a credit card?

Instead of using an online credit card, another line of credit option to buy things over the internet is through quick loans from MoneyMe. We offer cash loans that range from $5,000 to $50,000, and all it takes is a five-minute application to see if you’re eligible.

We’re all about responsible lending; that’s why we only offer loan terms that you can comfortably repay. MoneyMe won’t let you bite off more than you can chew. You’ll be able to repay your loans through our convenient scheduling and reminders based on your pay cycle.

How to do credit card scams online?

Before the Freestyle Card and application, even the best credit cards were susceptible to scams. Traditionally, it would happen through illegal devices called skimmers. These tools gathered the physical card’s information through its magnetic strip. Afterwards, the perpetrator could apply that information onto a fake credit card and then make online transactions under the victim’s name.

However, this type of crime does not occur that often anymore as there is a new generation of credit cards. The MoneyMe Freestyle Card allows you to secure your information through the safety of your phone. This way, skimmers can no longer gather data from the card’s magnetic strip as there is no physical card to begin with.

How to do online payment through credit card?

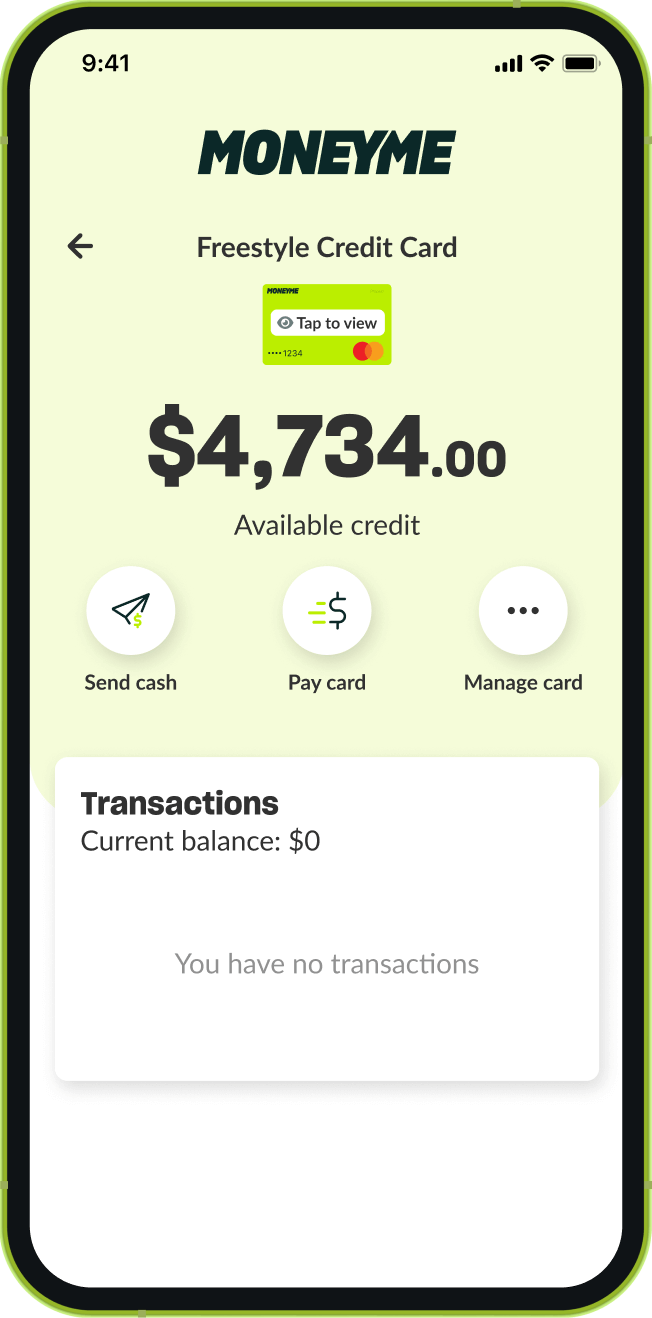

Paying over the internet has been made easy through the online credit card from MoneyMe. Simply begin by logging in to your Freestyle Card account. Next, tap the virtual card on the screen to see the three important pieces of card information: the card number, expiry date, and the CCV. Afterwards, input this information into the website you wish to order from, finish the checkout process, and wait for the product or service to arrive.

How to pay NAB credit card online?

Using the National Australia Bank (NAB) application is an easy way to repay credit card services. Follow these basic steps to complete the repayment process.

- Download and log in to the NAB application.

- Choose which online credit card you would like to repay and double-check the transaction history.

- On the top portion of the online platform, click ‘Pay’ and then select ‘To your card’.

- Choose the transaction account you wish to use to pay off the online credit card transactions.

- Select the option you would like to utilise within your transaction account (current balance, statement closing balance, required payment).

- Click ‘Next’ and then confirm all the details to complete the repayment process.

While our repayment options in MoneyMe are as easy as NAB (if not easier), we provide you with the added benefit of breathing room.

We understand that things don’t always go according to plan. That is why with our variable-term payment, you can give added payments or repay in full with no additional cost. Additionally, we can also reschedule your payment for up to 7 days for free so that you don’t have to worry about super strict deadlines.

Credit Card

Here at MoneyMe, we understand you not just as a credit card client, but as a consumer as well. This means that we provide services that make your life easier by taking into account your different needs as someone who lives in a fast-paced environment.

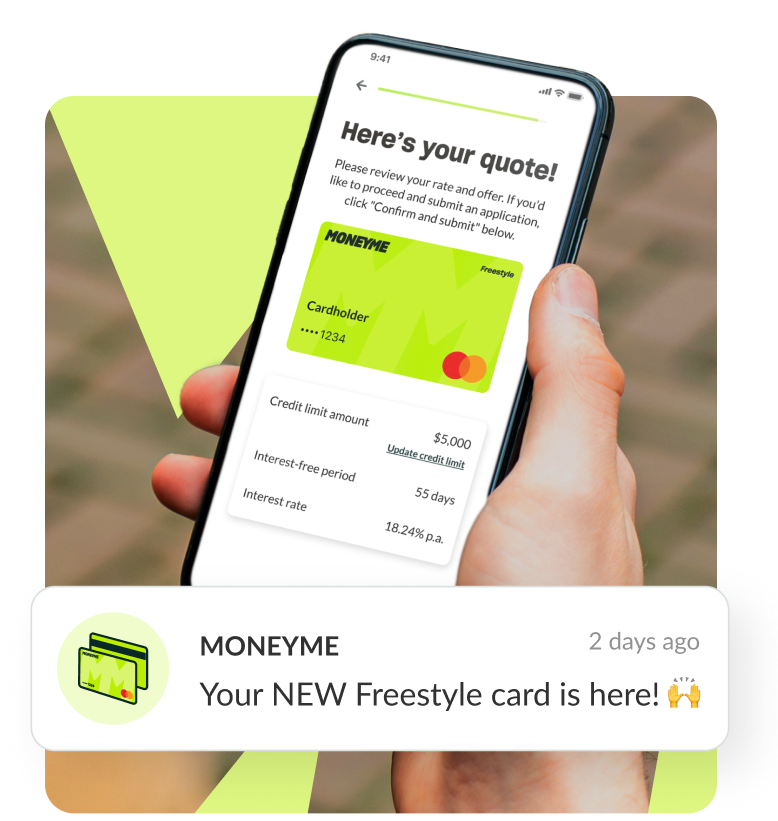

For this reason, we have created an all-in-one easy approval credit card fit for just about any use. Our MoneyMe Freestyle Mastercard has all the features of a credit card for temporary residents, student credit cards, and much more.

Aside from this, with our personal credit card, you can enjoy additional benefits on top of our low interest rate of 18.74% per annum. Our unique service provides a same-day approval, virtual form factor, and credit back MoneyMe perks, among other advantages.

Apply for our solution today using the MoneyMe credit card application and cover all sorts of expenses. From rent due to holiday layby agreements – allow our reliable credit option to handle the charges.

How do credit cards work?

Understanding the Freestyle virtual credit card from MoneyMe is easy if you think of it as simple cash loans online.

When you set up your account, we give you a specific credit limit based on your credit score. However, unlike a bank or traditional credit institution, we also check other important factors such as generated income, debt obligations from bank loan programs, and the living expenses in your area.

Afterwards, we will approve your MoneyMe account so that you can instantly buy products or services and then pay for them using the Freestyle virtual credit card. Then, all that’s left for you to do is pay off your balance based on the agreed-upon repayment terms.

That’s basically all there is to it – a MoneyMe credit card is an easy concept to wrap your head around. Create a Freestyle account today to complete any transaction that accepts Mastercard and even redeem credit from over 1,700 of our partner stores.

What is a credit card?

Traditionally, a credit card is a small rectangular plastic product that allows you to spend money that comes from your selected provider. It gives you the ability to purchase goods or services at an earlier time as actual payments are set in the future.

However, MoneyMe online credit cards have a unique virtual aspect to them. Instead of carrying this traditional rectangular piece of plastic, you can just bring out your mobile phone and use the Tap n Pay in-store option. Additionally, you can view your credit card number, expiration date, and CCV on the MoneyMe platform for online purchases.

With this convenient model, you won’t even have to bring your wallet with you anymore when you download our mobile app. Just bring your phone with you then enjoy life through paperless processes.

How to get a credit card?

For a traditional bank credit card, you would have to plan a trip to one of the physical branches. Once you get there, you have to wait in line for their staff to assist you, then fill out stacks of paperwork and submit other requirements such as a savings statement.

We don’t know about you, but that doesn’t sound like a lot of fun. With MoneyMe, you can skip that stress-filled process and even apply for a Freestyle credit card while lying in bed.

Simply make sure that you are 18 years or older, an Australian citizen, and currently employed. If all of those conditions are met, then you are eligible for our effortless application procedure.

To get to enjoy our Freestyle card, input the necessary financial data in our mobile app, allow us to give you a fair credit limit based on the provided information, and that’s it – an approved application and a ready-to-use credit card.

What is a balance transfer credit card?

A balance transfer credit card gives you the power to pass on the balance you are obliged to pay from one card to another. This effectively makes it so that you don’t have to worry about multiple small debts, but one consolidated one instead.

However, with this type of credit card, banks generally charge more with regard to purchasing interest. They do this so that they can cover the expense lost from the lower credit balance interest rate.

With MoneyMe, you can avoid the high purchase interest associated with balance transfer credit cards from banks. We provide you with small debt consolidation loans so that you can fully repay all your other loans. The best part is that you can save more with our option as we have a unique MoneyMe credit rating system that allows you to have less interest the higher your placement is.

Apply for a consolidation loan from MoneyMe and increase your rating from an A5 to an A1+ in no time. Start making consistent repayments with us and save more in the long run.

How to apply for a credit card?

Applying for a MoneyMe Freestyle card is a simple task anybody can do. Just follow these basic steps and have your application approved in just a few minutes.

First, make sure that you are eligible for our credit products. If you are a working Australian citizen aged 18 or older, then you can proceed to the next step.

Next, download our mobile phone application available on all types of smartphones. Doing this will allow you to view your card details and receive notifications about your repayment status.

After the app has been installed, create an account and Freestyle card request. Here, you will have to type in information about your financial situation so that we can decide on a fair credit limit for you.

Lastly, wait for our expert MoneyMe team to approve your request, then instantly enjoy your fully functional virtual credit card.

With that simple process, say hello to our Freestyle option and goodbye to those clunky plastic cards. Join us here at MoneyMe and step into the future of money borrowing!

Can I get a credit card online?

In order to get an online credit card from MoneyMe, you must be above 18 years old, an Australian citizen, and have a steady income source.

If you are eligible, you can apply through the phone or by going to the physical branch. On the other hand, you can also apply online through our website or through the mobile application available on both the Apple App Store and Google Play Store.

Sign up now as the application process and approval will only take a couple of minutes of your time.

Is it safe to shop online with a credit card?

Using the online shopping card from MoneyMe is absolutely safe and seamless. All you have to do is shop from trusted websites or marketplaces online and keep your account details secure on your end.

However, if your device with the Freestyle Card information has been stolen or lost, contact us right away through 1300 605 186. Additionally, after contacting the number, you may need to send us a written statement regarding the stolen phone for legal and procedural purposes. By doing this, we can cancel or suspend your online credit card so that unjust transactions may be void.