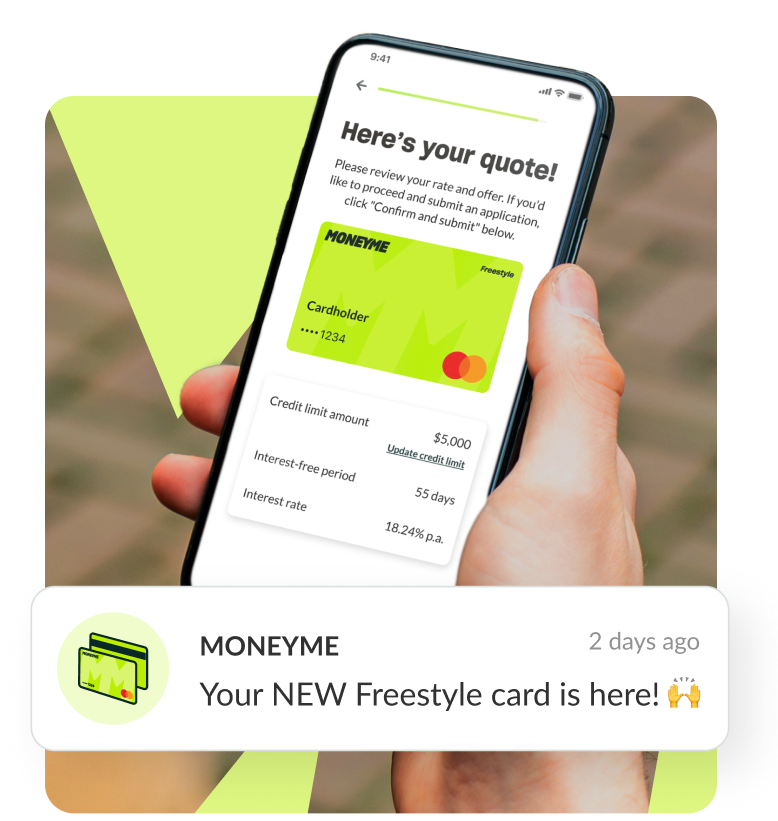

Everything you

need in one app

Apply in minutes and manage your account

wherever and whenever you need it.