A new, better way to access credit

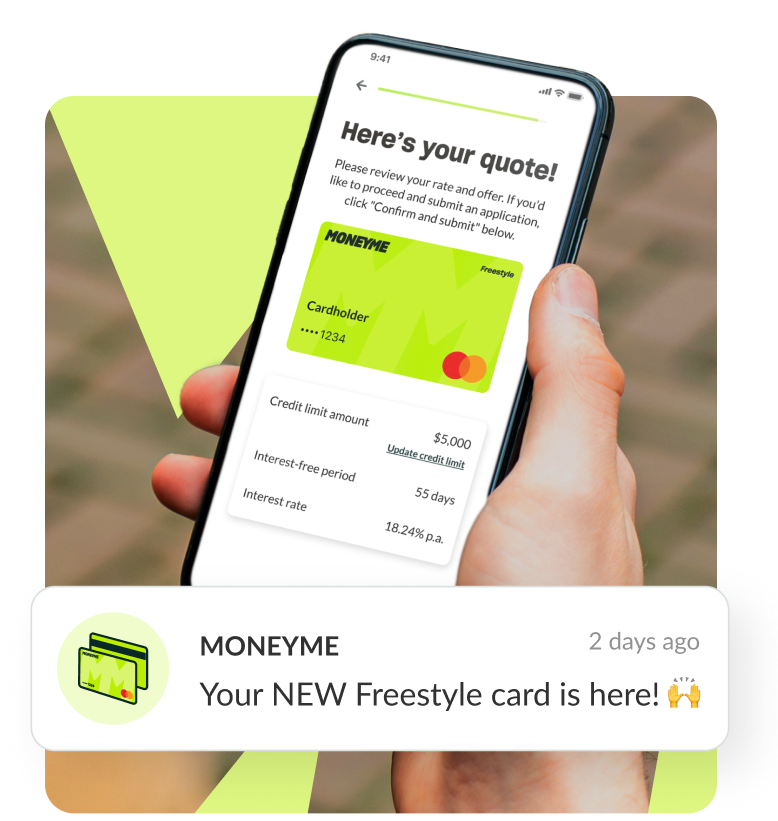

Introducing Freestyle, the virtual credit card. It’s the latest innovation in credit cards that is stored virtually on your phone, and not in your wallet.

With Freestyle, you can use your line of credit up to $20,000 anytime, anywhere. Unlike conventional credit cards, Freestyle is entirely online and lives on your smartphones. Accessing your credit is now faster and easier, just the way it should be.

Here at MoneyMe, we do things straightforward and hassle-free. And as part of our commitment to be the credit provider of choice for Gen Now, we are giving you the freedom to access and manage your credit whenever you need it. Freestyle is designed to respond to this generation’s growing need for quick access and convenient solutions. In just a few taps, you can Tap N Pay, purchase in-store or online, and transfer funds to your bank account.

Easy Tap n Pay solution

Rather than asking you to load your credit card number and other details into payment apps, our virtual credit card type product takes a further leap by keeping everything online, including the card itself. Using Freestyle is easy and simple, but the possibilities are endless.

It’s much more convenient to keep all the important things in one secure accessible place. The things that used to be on your desks, such as phone books and calendars, are now stored in your phone. And with MoneyMe, it becomes possible for your credit card, too. The virtual credit card is accepted anywhere that accepts Mastercard online or via Tap n Pay in-store. Now, it’s one tap away when you need it to cover unexpected costs, or when you need to go on a holiday and book your travel. It’s one tap away when you need emergency cash-outs for car repairs, big utility bills or when you simply need easy money for your everyday, on-the-go needs.

Our virtual credit card provides you with the extra cash you need to enjoy your lifestyle. You can use it to Tap n Pay for your coffee on your way to work, book your next travel online when using miles is just not an option, or simply indulge on your favourite thigs. You can also use it for emergency expenses, or when you need to transfer cash to your bank account. Freestyle helps you stay on top of things, giving you credit right in the palm of your hands.

How to get a virtual credit card

The application for the virtual credit card is entirely online and just takes minutes to complete. Unlike mini loans, the Freestyle virtual credit card allows you to withdraw as you need it. Use it to transfer cash directly to your account or pay for big-ticket items and bills straight from your Freestyle app. You can count on it to keep your cash flow healthy and secure, so you’re always ready no matter what comes your way.

When you apply for a virtual credit card, you go through the same review process that our personal loans and other loans online customers do. Apart from your credit score, we take into account other factors to assess your eligibility for credit, such as your credit history, income, debit cards or debt obligations, and living expenses. As part of our approval process, we also assign you with a MoneyMe loan rating based on your credit report and history. And we offer fair and tailored rates to make sure you are comfortable with your repayments.

Each time you take out fast cash loans or same day loans and make your repayments on time, your MoneyMe loan rating may improve. We can re-evaluate your account and when it reflects positive repayment history, you may be able to get better loan terms and lower rates.

For your on-the-go lifestyle

The Freestyle Virtual Credit Card is available for up to $20,000 that you can use to fund your ideal lifestyle. Get a same-day outcome and just like express cash loans, you can use it for big and small life events. Use it to buy your groceries or pay the bond on a new rental property. Use it to pay for school supplies like university or college essentials. When you need access to fast, easy and simple credit funds, your Freestyle Virtual Credit Card is here to help you out.

Shop online or in-store, pay for your cab ride or go out with your friends. With MoneyMe’s Freestyle Virtual Credit Card, you have a steady and reliable line of credit whenever and wherever you need it.

Virtual credit card requirements

To qualify for a virtual credit card or any of the MoneyMe credit products, you have to be employed, above 18 years old and an Australian resident.

The application process is completely online, without any paperwork. We don’t like long queues, days of waiting and lengthy forms just like you. When you apply for credit with us, we verify your details by asking for your online bank statement. Through our secure portal we get access to them as read-only 90-day documents in PDF format. These snapshots, along with your personal, employment and spending details, are all we need to come up with a decision for your virtual credit card application. It’s fair, simple and straightforward.

Apply online, get an outcome within minutes and start using Freestyle instantly. Everything is fast and online – you can even sign your contract digitally. Getting access to funds has never been easier!

How to set up a virtual credit card?

Setting up your virtual credit card begins with signing up on our site, applying for the virtual credit card, and then waiting for a bit of time to see if your request has been approved.

Our first step is to look at your credit score and other financial factors. We also ask for some personal information to help us determine whether our service can work for you. After that, our AI-based future technology determines if you meet our virtual credit card criteria and how much your credit limit will be.

The application and wait should only take a couple of minutes, and once you’ve been approved, you can simply log in to our MoneyMe app to formally begin using the card. You can also view your card details and other relevant information through the application.

MoneyMe is dedicated to giving you the smoothest and quickest application experience possible, saving you valuable time and energy. There is no need to wait weeks for your card to arrive, as we offer a truly virtual and speedy experience.

How does a virtual credit card work?

Our virtual credit card works just like any other physical credit card, except it sits on your phone rather than in your wallet.

You can use it to tap and pay in physical stores and utilise the MoneyMe app to make any digital transactions. You can use your virtual credit card at over 1,400 online and in-store retailers, from the biggest merchants to smaller businesses. This can be done through the card details stored digitally on your phone or our MoneyMe app.

Through our MoneyMe Perks benefits system, you can earn credit back when you make purchases through our app at participating online stores. Our perks system allows you to save some money and pay less. It’s like earning a commission but by buying the things you need.

Whether you’re spending money on new shoes or a kitchen renovation, rest assured that our virtual credit card can get you what you need, when and where you need it.

How to create a virtual credit card for free?

Honestly speaking, there are no free virtual credit cards, but our service is so efficient that you can use it with minimal charges.

Not only do we offer fast online approval, but we offer interest-free terms and lower rates than other banks in Australia.

Our monthly and annual fees can be non-existent depending on your credit limit and the balance in your account. This allows you to easily buy now pay later for anything you might need.

Get your virtual credit card today by going to our website and clicking ‘Apply now’. The application is entirely online, fast, and mobile-friendly, meaning you can apply anywhere at any time. Simply complete the three-minute online application to get an outcome in minutes.

What is a virtual terminal for processing credit cards?

Businesses can accept virtual debit cards and credit cards with a virtual terminal. Virtual terminals don't require physical terminal systems or physical cards to accept payments.

When you pay for anything using a virtual terminal, the retailer receives your virtual credit card information to make a payment. Payment data is then automatically sent to the payment processor to process the payment.

You can find this being used in many online retailers, especially those that sell services. Since virtual terminals often require card security codes that only you can enter, they are relatively secure.

How to create virtual credit card?

Click the ‘Apply now’ button on our website to create a virtual credit card right now. The entire application process is online, fast, and mobile-friendly, which means you can apply wherever and whenever you like.

Just take three minutes to complete the online application, and you will receive an answer if you are eligible in a matter of minutes. The MoneyMe virtual credit card gives you all the freedom and convenience to do the things you love, like travelling and shopping, without any hassles.

Additionally, you can participate in MoneyMe Perks when you use our card. You earn credit back by purchasing through our app at participating online retailers. Our rewards program allows you to earn some credit back while saving some money.

How to get free virtual credit card?

Use our virtual credit card at MoneyMe with minimal expenses as we offer lower rates and fast approvals. This allows you to get an almost free virtual credit card.

You can utilise our virtual credit card for various reasons, from home renovations to simply paying the bills. We simply require you to repay our loans after a couple of weeks to avoid charging you any fees.

Our virtual bank card also prevents you from spending too much, as you can easily track your money through our app. Additionally, making virtual card payments using our app saves you from fraud as merchants do not directly access your personal information.

How to get free virtual credit card with money?

There’s no way to receive a free virtual credit card with money. However, MoneyMe can help you get whatever financial support you need for any project or purchase. Our service is so practical that you can use it with minimal charges, paying only for what you bought.

There is no need for those burner credit cards, as we offer interest-free terms for up to 55 days and lower interest rates than other services. Our monthly and annual fees can also be non-existent depending on your credit limit and account balance.

MoneyMe also provides other services, such as offering quick personal loans in case of any emergency scenario such as abrupt medical bills, so be sure to check out our site so you can get a feel of what services we can help you with.

How to get virtual credit card?

You can get and create a virtual credit card right now by clicking the ‘Apply now’ button on our website. Online applications are fast and mobile-friendly, so you can submit them wherever and whenever you want. No need to look for those sketchy one-time-use credit cards or disposable credit cards with our service.

If you have all the details we need, you can complete the online application form in just a few minutes. You’ll also know whether your application has been approved in minutes, not days, compared to other services. Once approved, you can then use it right away using the card information provided in the MoneyMe app, rather than waiting for the card to arrive in the mail.

Using the MoneyMe virtual credit card, you can do the things you love, such as travelling for a holiday and shopping for a new phone, without the hassle.

What is a virtual credit card?

A virtual credit card is exactly like a physical credit card, just digital. You can use it for online purchases or add it to your phone’s payment system for secure, contactless in-store purchases.

This virtual credit card can be stored in your phone through its payment system and used very flexibly.

Our virtual credit card at MoneyMe provides you with many benefits like instant activation, meaning your card can be used as soon as it is approved. Additionally, you can easily manage your funds through our app, allowing you to make bank transfers whenever you receive income.

What is a virtual credit card number?

Virtual card numbers are very similar to physical credit or charge cards. Virtual card numbers have a 16-digit number generated and assigned by an individual user.

Uniquely, virtual card numbers can be used immediately, providing just-in-time funding that could help better manage your cash flow. Our virtual card also provides spending controls, reporting tools, and fraud protections that help manage expenses, track projects, and prevent misuse.

Our virtual cards can also provide privacy and added insurance for our customers. Purchases are more difficult to be tracked and targeted by advertisers while protecting sensitive banking information, giving you privacy.