Want to know the difference between your credit card vs debit card? We break down what each of those cards is and how to tell the difference between them. When you choose MoneyMe as your credit provider, there is no confusion because our Freestyle credit card doesn’t take up space in your wallet. It lives on your smartphone instead. If you’re looking for a fast and hassle-free credit provider who offers things like a fast credit card application online and low doc personal loan process, then you’re looking for MoneyMe. Apply online in just minutes and you’ll typically receive your approval within the hour.

How does an interest-free credit card work?

How are credit and debit cards different?

Your credit card is a revolving line of credit that connects you to a pre-approved credit balance. It’s not your cash but it is cash that you can when you’re shopping in-store and online. At the end of every month, your credit provider sends you a credit bill showing you what you have spent on your credit card and the minimum monthly repayment that is due. You can choose to pay only the minimum payment, or you can choose to increase your repayments to help you chop down on the interest you have been charged.

All credit is offered at an interest rate. This is like a lending fee that the credit provider charges for using the line of credit they have extended to you. To help you avoid high interest charges, money lenders like MoneyMe offer customers interest-free periods on the credit that they use. When you repay your credit balance within the interest-free period then you’re essentially using an interest-free credit card.

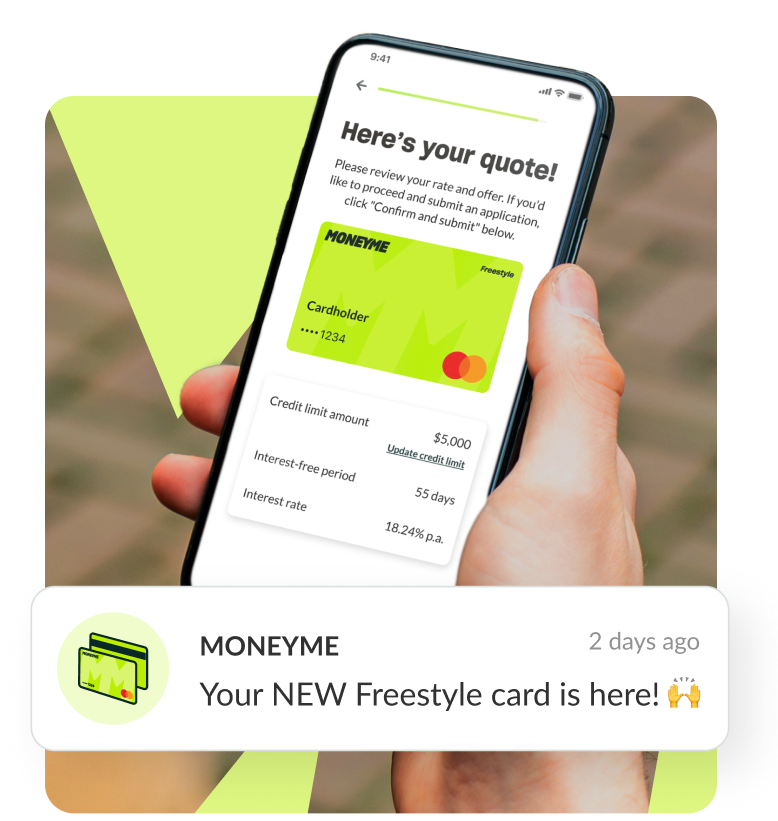

When you choose MoneyMe and our Freestyle virtual Mastercard®, for example, you can access up to 55 days interest-free on purchases made. That means that when you use your card for instore shopping wherever Tap n Pay is accepted, or for online shopping, you will not be charged interest on that balance for up to 55 days. When you sit and work out the interest-free period offered by popular buy now and pay later services you actually find that they generally only offer 42 days interest-free. Choosing Freestyle means you access up to 13 days extra! That’s almost an entire fortnight longer.

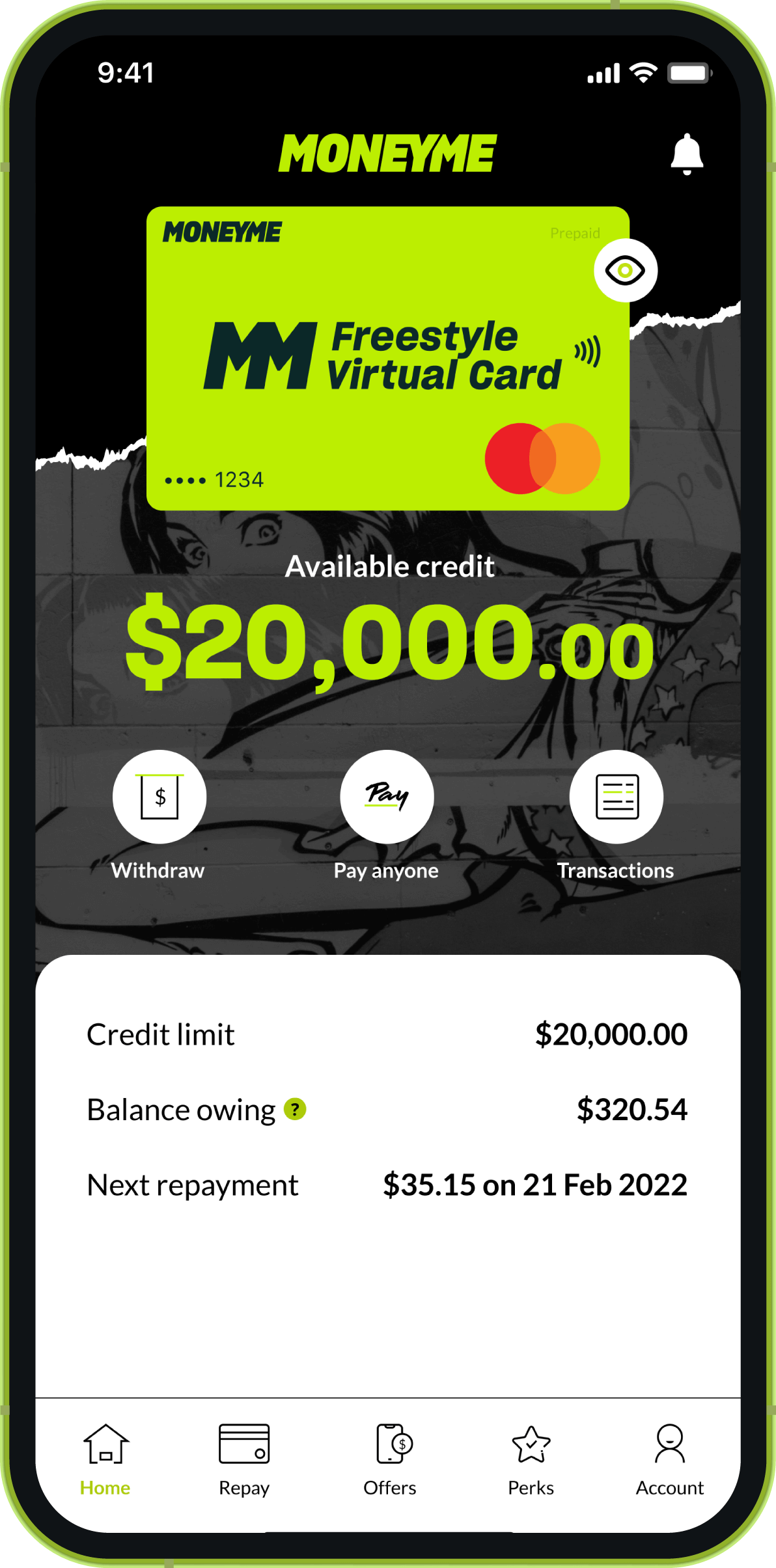

Freestyle is more flexible in lots of little and important ways. Where buy now and pay later services only offer you limited shopping opportunities, the Freestyle credit card is powered by Mastercard and accepted nearly everywhere. You also have additional features like cash transfers from your credit account to your normal everyday banking account so you can give yourself a quick cash loan when you need it. You can even send cash to other people’s accounts too. Interest charged on cash transfers is different to purchases so please view our full fees and charges online. We’re committed to ensuring that all of our customers understand exactly how our credit products work so you can check our lowest interest rates, our monthly and annual fee schedule as well as all our terms and conditions via our website.

So, how is your credit card different to your debit card? Your debit card is connected to your everyday banking account that your salary is paid into. A debit card gives you access to that cash. It’s the cash that you pay for your rent or your mortgage with, etc. Your debit card is a piece of plastic that lives near your licence or your Medicare card in your wallet. The Freestyle virtual Mastercard® doesn’t live in your wallet.

We’re the Gen Now money lender and we’ve tailored our credit services to the latest generation of spenders who want things like instant credit card approval and fast cash when they need it. When you apply online with MoneyMe it takes you just minutes to complete and submit your application for both our fast approval credit card and our fixed rate personal loan products. It’s a low doc process so you’ll need your basic forms of identification and that’s about it.

At the end of your application, you’ll be asked to input your online banking credentials which gives your personal loan broker a PDF format statement of the last 90 days related to your everyday banking account. This allows us to instantly verify your salary and living expenses and it’s the secret to how we’re able to offer express loans and credit cards to our customers. It’s all secure, backed by illion’s bank level encryption software, and we don’t get any access to your online bank account or your login details. We only receive a read only statement of the last 90 days of transactions.

Can you use a credit card like a debit card?

Both your credit card and debit card give you access to cash. You can use your Freestyle virtual Mastercard® to pay for anything that you would usually use your debit card to pay for from shopping for clothes, paying your bills, buying petrol and groceries. Your credit card offers you a pre-approved credit balance that you can spend up to. As soon as you have repaid some of the credit funds that you have used, those funds become instantly available again. This can offer you great benefits like setting a strict monthly spending budget for yourself. You know ahead of time what you can spend and then when your pay cycle rolls around you can repay your used credit funds (hopefully within the interest-free period) and then use those funds again for the next month.

How to know if your card is debit or credit?

Your debit card is issued by your bank so it will bear the logo of your everyday banking account. It will usually also say whether it’s a debit card on the actual card. Some banks offer customers credit facilities like overdraughts which allow you to use more cash than is technically in your account. An overdraught is another type of credit product and it will also be offered at a set interest rate as well as with additional fees. You usually have to apply for an overdraught so if you don’t remember applying for one then you probably don’t have one.

If you’re at all confused about which cards are credit cards and which cards are debit cards, then speak with your bank to confirm. You’ll always know that Freestyle is your credit card because it lives in your smartphone and not your wallet. You can access everything you need including a quick look dashboard via your smartphone which clearly shows you what you have spent, what you owe and when your next payment is due. You can also manage all of your personal loans via your smartphone as well. We’re about easy finance and fast ways to borrow money so making sure that you can access everything you need at the swipe of a finger is our top priority.

How could the Freestyle virtual credit card offer you a little more flexibility in your life? Apply online now for fast access to the cash you need. Approvals are usually received within the hour when you apply during our business hours and once approved your cash is instantly available.