If you’re looking for student credit cards with friendly terms and low rates, then you’re going to love MoneyMe and our Freestyle virtual Mastercard®. We are the tech-savvy money lenders who offer fast approvals and painless applications. It takes you just minutes to complete a new application and submit it. Balances are available for between $1,000 and $20,000 and as long as you meet our credit criteria, you’re free to apply right now.

Can a student apply for a credit card?

When you choose MoneyMe, you absolutely can apply for student credit cards in the form of our Freestyle Mastercard. To be eligible to apply for any credit product offered by us you must be at least 18 years of age, currently employed and a permanent resident in Australia. If you fit those criteria, then you’re ready to go.

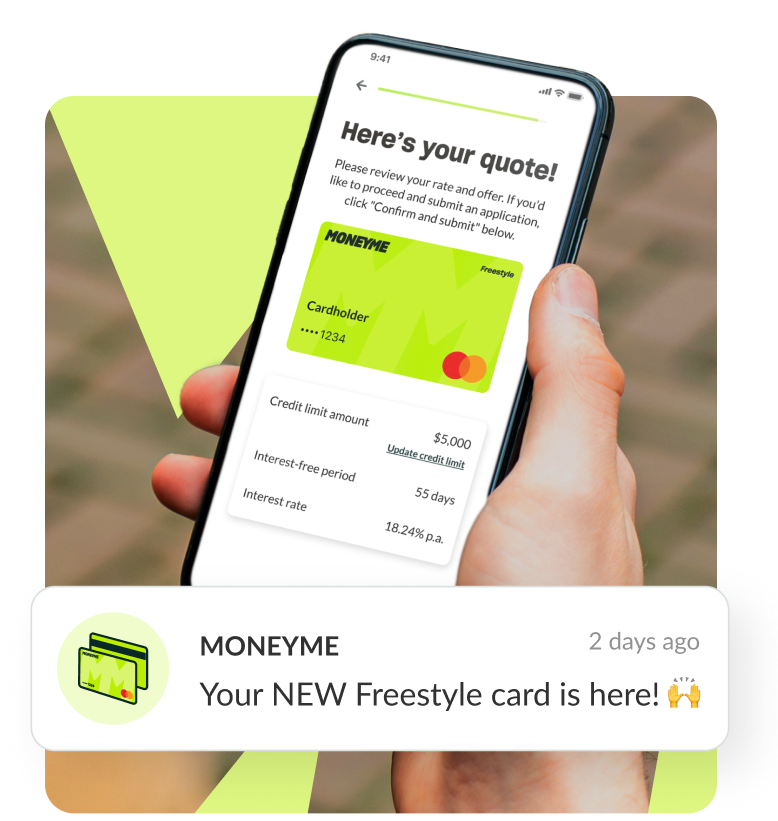

Getting credit as a student can be tough and knowing how to handle your credit when you’re just starting out can be even tougher. We’re a fair and responsible money lender and we have tailored our credit card application online as well as our low doc personal loan applications to be fast, easy to complete and intuitive. We use a range of cutting edge technologies to verify your application details and design an affordable credit option that we believe is comfortable for you. Applications take you just minutes to complete and submit and approvals are fast. Our fast approval credit card will normally have an answer to you within the hour when you apply during our business hours. If you’re happy with the offer, we have made you then signing up is just as quick and easy. Simply read your new credit contract carefully so you understand the various fees and charges as well as terms and conditions of use, then digitally sign your contract. Once we receive your signed contract, we make your new funds instantly available.

Which credit card is the best for students?

There is no ‘best’ option for everyone when it comes to credit cards. Everyone is different and everyone’s financial circumstances are different so what works well for you might not work as well for another person. For this reason, the best student credit cards are the ones that work the best for you. Doing a thorough credit card comparison when you’re still shopping for a provider is a great way to quickly and easily review any promotions and ongoing offers you’ve found. To make it easy to check whether MoneyMe and our Freestyle virtual Mastercard® is right for you, review this quick list of features and benefits:

1. Interest-free days

Low interest rates are one thing but what about an interest-free credit card? With Freestyle, customers have access to up to 55 days interest-free on purchases made. When you compare this to popular buy now and pay later options which normally offer you 4 fortnights to repay your debt interest-free, you find that those 4 fortnights actually equate to 42 days. That’s almost two weeks less than what we offer Freestyle customers. You don’t need a minimum spend either or have to worry about whether your favourite stores accept buy now and pay later options. Because Freestyle is powered by Mastercard, it’s accepted nearly everywhere.

2. Low fees

When you choose Freestyle, you pay no monthly fees when your credit balance is less than $20. Annual fees are tiered depending on the credit limit that you have.

3. No bull and no fuss applications

We specialise in an instant approval credit card processes designed to be quick and easy for both you and us. You can apply online in just minutes with some basic forms of identification. At the end of your application form, you won’t be asked to upload your payslips and we won’t need to verify your employment data with your boss. Instead, we’ll ask you to input your online banking details with your regular banking platform. Doing this gives our assessment team access to a ready only (PDF format) 90-day bank statement showing your most recent transactions. This instantly verifies things like your salary, your living expenses and other debt commitments that you have.

4. Get rewards

We specialise in an instant approval credit card processes designed to be quick and easy for both you and us. You can apply online in just minutes with some basic forms of identification. At the end of your application form, you won’t be asked to upload your payslips and we won’t need to verify your employment data with your boss. Instead, we’ll ask you to input your online banking details with your regular banking platform. Doing this gives our assessment team access to a ready only (PDF format) 90-day bank statement showing your most recent transactions. This instantly verifies things like your salary, your living expenses and other debt commitments that you have.

5.Online credit card

Sick of having to lug your wallet around with you or worried you’ll lose your cards when you’re out? Don’t worry about it with Freestyle. Rather than a plastic bank card that takes weeks to arrive in the mail, your Freestyle account lives on your smartphone which means that you can use it in-store wherever Tap n Pay is accepted as well as for fast and easy online shopping. It also means that when you apply with us, your credit is instantly available to use.

6. Get rewards

Freestyle is available credit limits between $1,000 and $20,000. You can apply to increase or decrease your credit limit quickly and easily via your smartphone too.

How to apply for a student credit card?

Applying for a student credit card should be fast and it should be painless. As long as you meet our eligibility criteria then you’re ready to go. Applying can be done online via our website and takes you just minutes to complete and submit. When you apply during business hours expect an instant response within the hour.

Can I use credit card to pay off a student loan?

If you’re looking to refinance a personal loan like a student loan, then you have a couple of options to choose from. You can always get a revolving line of credit like Freestyle to help you pay out the balance or you can choose a personal loan for debt consolidation instead. Our fixed rate personal loans are available for balances between $5,000 and $50,000. Applying is just as easy and happens all online. You can get a loan large enough to cover off your remaining student debt and leave you a little something left over for some celebratory spending or for clearing our any other small loans or debts that you have too.

Paying out a debt (or a bunch of debts) with one personal loan can help simplify your credit and help you save on costly fees and interest. Instead of paying multiple creditors and getting trapped in compounding interest, you pay just one credit provider a fixed repayment amount every month. You know how much the loan will cost you ahead of time and how long it will take to repay it. The best bit about choosing MoneyMe? We don’t charge you early termination fees when you want to clear out your loan balance early so you can save money when you’re ahead of your finances.

Ready to apply for our Freestyle student credit card or any of our express loan products? Get started now on your application and submit it in just minutes. MoneyMe are the easy finance specialists who offer fast cash when you need it. Apply now.