MoneyMe offers customers a quick online application process and fast approvals for a line of credit Perth customers can leverage to access hassle-free credit whenever they need it. We are an Australian accredited lender, but we like to do things a little differently to make accessing finances simple and easy for our customers.

We're an online-only company, so the first benefit to our customers is that there's no unnecessary paperwork involved in getting your loan approved or even applying; everything is completed right on our website from the convenience of your own home. Unlike traditional personal loans, where you pay off over time at set intervals each month, a line of credit provides access to more monetary help whenever it’s needed within one single limit amount that can be increased if required.

Compared to other types of loans where you might have to wait weeks before you get your next payment from an instalment plan, a line of credit will give you money as soon as you need it and however much of it you need to access, like in case of emergencies. A line of credit is a type of revolving loan that lets you access funds anytime, anywhere, and are typically either secured lines of credit or unsecured lines of credit. It’s never been easier to apply for a line of credit Perth customers can start enjoying fast.

Secured lines of credit are backed by collateral – which means you need to secure your line of credit against your personal assets, such as your home equity, car, or another type of financial asset. The lender has the right to seize the asset if you fail to repay your line of credit, which is why the interest rates are typically lower.

On the other hand, an unsecured line of credit is not backed by any asset. Since there is no collateral involved, it usually comes with higher interest rates to pose lesser risks to the lender.

At MoneyMe, we are excited to be offering an accessible line of credit Perth customers can use when they need it, however they need to access it.

Is it a good idea to get a line of credit?

Unlike a traditional personal loan that you pay off on a fixed term, a line of credit provides you access to credit or extra cash today – and every day – within your credit limit. With a line of credit, the balance you pay becomes available for use again. This can be much handier than applying for a typical education loan, travel loans or even renovation loans which lock you in with funds you can’t access easily once repaid.

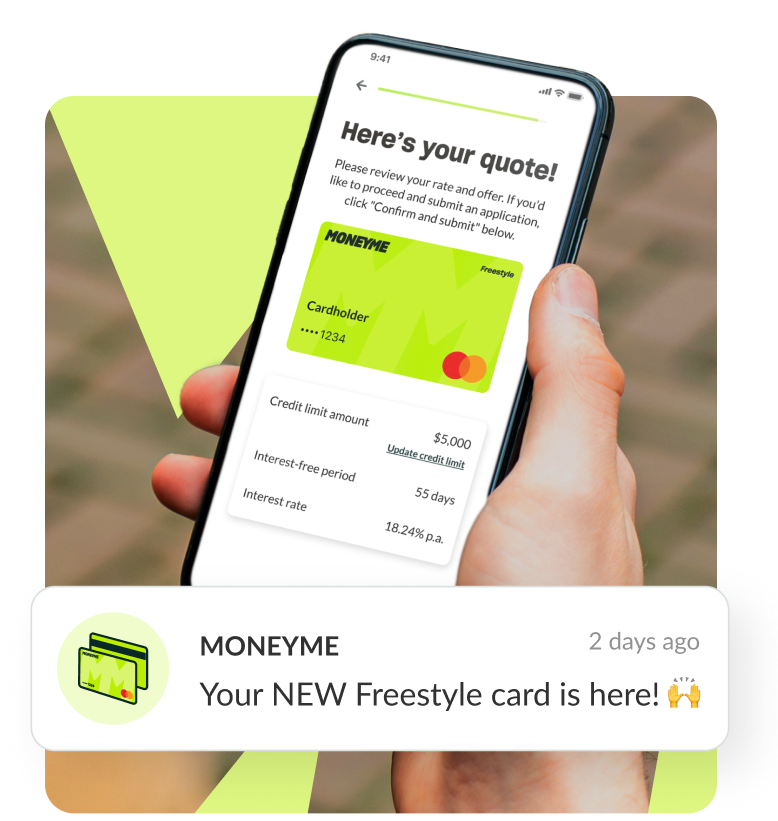

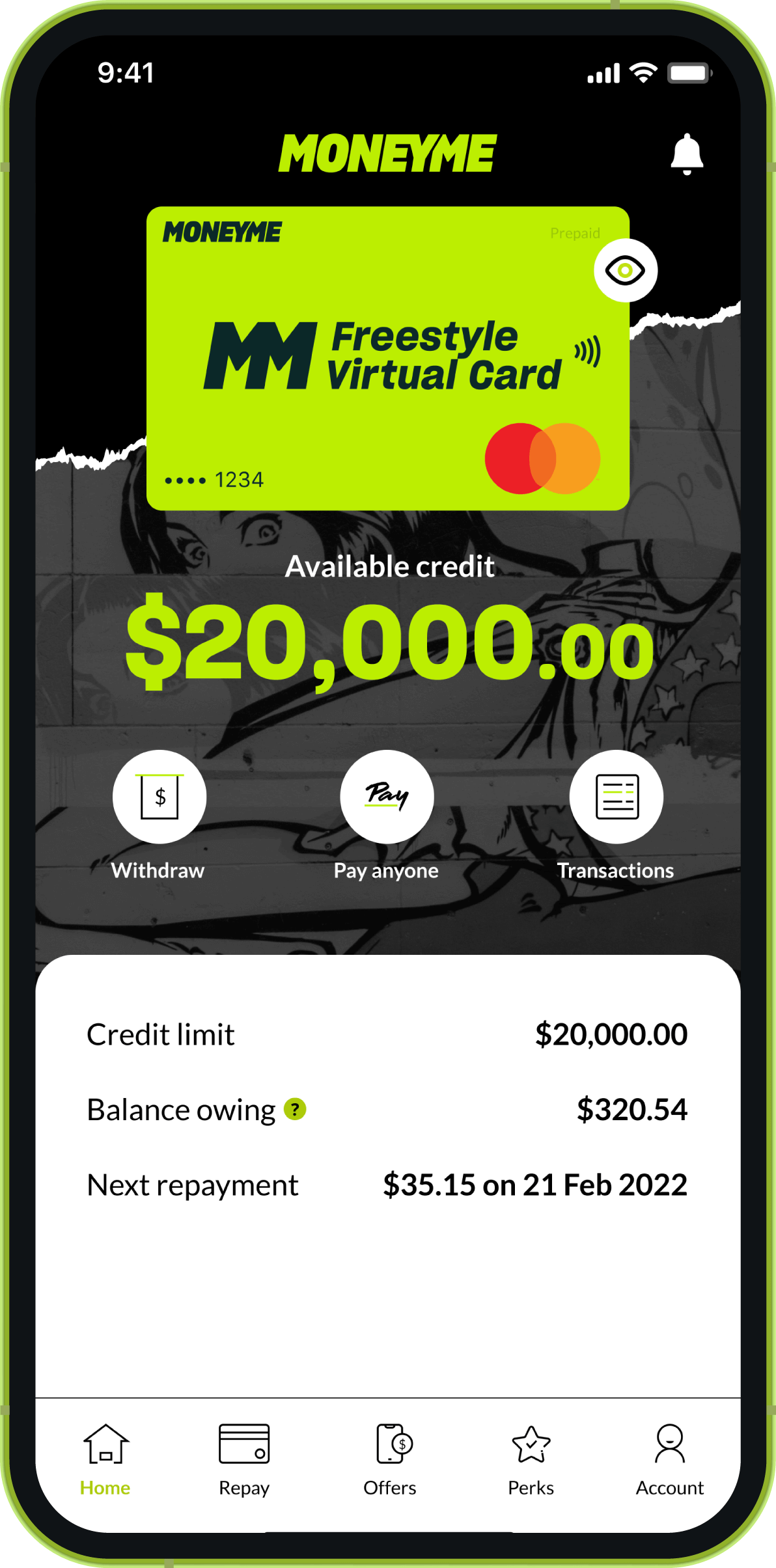

With a line of credit Perth customers can borrow up to their maximum credit limit, with funds readily available to use again once they have been repaid. Your monthly payment amount on a line of credit relies on your interest rate, outstanding balance and the agreed terms. A personal loan gives you a lump sum, which makes monthly repayments easier to budget. So the real answer depends on what credit solution better fits your needs and financial situation when you want to apply for one.

The common fees associated with a line of credit are annual fee, monthly fee and interest rate. But in a line of credit, you don’t need to pay any interest unless you have used your money. We base the annual fee on your credit limit, and the monthly fee is waived if your balance is less than a specific amount.

How much money can I borrow with a line of credit?

When borrowing a line of credit Perth customers have a potential limit of up to $20,000 and start at $1,000 – we’ve got you covered for everything between these amounts. The exact amount you will be approved for will depend on the health of your application and previous credit history but rest assured that MoneyMe is here to make sure that accessing the funds you need is easy and possible.

If you are approved for $10,000 on a line of credit, you may borrow up to $10,000. But this doesn’t mean you are required to borrow and use the entire amount. You can borrow smaller amounts (e.g. $2,000, $5,000 – depending on how much you need). Once you have repaid whatever amount you borrowed, the cash becomes available again for you to use without the need to re-apply.

How to apply for a line of credit in Perth?

Applying for a line of credit in Perth is one of the easiest things you’ll ever do. You can hop online, begin your application, provide documentation via our secure online portal, and then sit back and wait for us to work our magic. If you are 18 years or older, a resident of Australia, and currently employed, then you are eligible to apply for our line of credit, easy loan, or short-term loans. As responsible moneylenders, we consider a range of factors such as your credit history, income, living expenses, and the existing small loans you may have before we make a decision. You might even be available for MoneyMe’s line of credit account service, Freestyle Virtual Credit Account, which is like a virtual credit card.

Apply online now for a hassle-free line of credit Perth customers can start enjoying straight away.