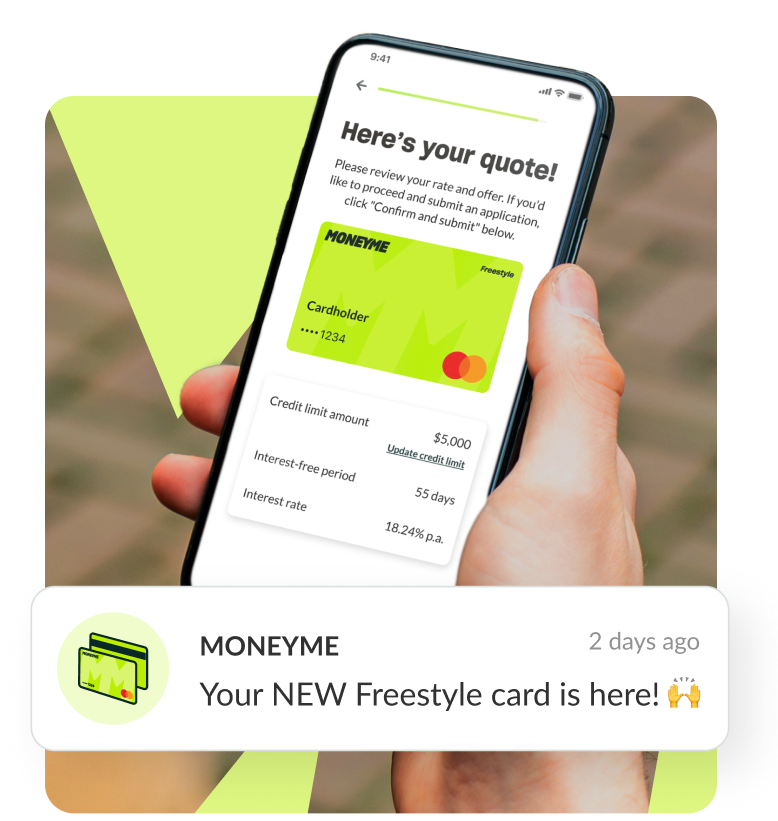

Get the right low rate credit card for you and compare your options to the Freestyle virtual Mastercard® available for between $1,000 and $20,000. We offer a host of benefits and perks to our credit customers across our entire range of products. Applications are quick and easy taking you just minutes to complete and submit online.

What is a low rate credit card?

A low rate credit card usually means that the credit provider is offering a lower than usual interest rate. Choosing a low interest rate credit card option can be a great way to help you save on credit costs but it’s not the only feature or perk worth keeping an eye out for when you’re searching for a great credit card. Other benefits include interest-free periods as well monthly and annual fees, how fast your application process takes and how easy it is to manage your credit with your new provider.

When you choose MoneyMe and our Freestyle virtual Mastercard®, you’re not only accessing competitive rates on your credit card, but you can also get up to 55 days interest-free on purchases that you make. Popular buy now and pay later options offering interest-free repayments usually take 4 fortnights to repay. This equates to 42 days interest-free. The Freestyle Mastercard offers you up to 55 days which means you get almost an entire extra fortnight. When you repay your credit balance within this period you are essentially using an interest free credit card.

Because our instant approval credit card is powered by Mastercard you can use almost anywhere while buy now and pay later options can be limiting, applying to only a select number of stores or, worse still, only a minimum amount. Some stores will only allow you to use a payment method like this if the cost of the item you’re purchasing is above a certain amount. With Freestyle, your interest-free period applies to all purchases that you make both in store and online.

Another great feature of the Freestyle online credit card is how quick and easy it is to get your hands on fast cash from us. We specialise in offering low doc personal loan applications and fast approval credit cards. Because we are a wholly online lender, everything you need takes place online. It only takes a matter of minutes to complete and submit a credit application with us, whether that’s for our instant approval credit card or any of our personal loan products. We don’t need lots of irritating paperwork and we probably won’t even need to call you to talk about your application. Instead, at the end of your application, you’ll be asked to input your online banking details with us. This gives your personal loan broker or your credit application assessor access to a read only PDF format statement of the last 90 days of bank transactions. We use this to instantly verify your application details like your salary and your living expenses and it’s the reason why we can offer such fast turnarounds on our applications.

When you apply for either a fixed rate personal loan or our Freestyle virtual Mastercard® during our business hours then you can usually expect to have your new funds available the very same day, depending on who you bank with.

What are the benefits of a low rate credit card?

The main benefits you get from a low rate credit card are lower interest on your credit funds. This helps you to save money over the long term, particularly on higher credit card balances. Interest on your credit card is charged daily (unless you have an interest-free period in which case interest is charged on those purchases after the interest-free period has lapsed) and then charged usually monthly to your credit card.

Low rate credit cards can look very attractive to anyone shopping for a credit option but it’s important to check whether that the low rate advertised is a fixed or variable rate. Some credit providers will try to lull you in with a low rate introductory period which might be great for you, depending on what you intend to use your credit card for. It’s a good idea to check what the actual interest rate will be on your credit card once the introductory or honeymoon period is over to see whether it makes sense to keep this option over the long term. If you’re looking for a credit card that you can use for your monthly spending, helping you keep to a comfortable living expenses budget, then the actual interest rate may not be so practical after a while.

Other fees and charges could also be higher with low rate credit cards like monthly or annual fees charged to your account. To help you keep your costs low and your credit a convenient and easy finance option, always check the fine print. We believe in no bull, straightforward credit so everything you need to know about any of our products is available to view on our website. If you do need more information about either our long term personal loans or our Freestyle account then you can live chat with an agent via our website, send us an email or gives us a call on 1300 913 522. Our business hours are 8 am to 9 pm Monday to Friday and 9 am to 9 pm Saturday and Sunday.

What is the maximum limit of a low rate credit card?

Every credit provider will have a maximum allowable credit limit for their credit cards, and this is usually not dependent on a type of card or introductory offer. With MoneyMe, the Freestyle virtual credit card is available for balances between $1,000 and $20,000. When you apply for any of our credit products you will be offered a fair and responsible credit limit that we believe you can comfortably afford. As a MoneyMe customer, you can build your credit rating with us by showing us what a reliable and trustworthy credit customer you are. When you have built up a solid history with us or when your personal financial circumstances have changed, you can apply to increase your limit with us via your smartphone in a quick and easy online form. The reverse is also true so if you have a higher credit limit than you think that you need, decreasing your credit limit is just as quick and simple.

Knowing what you can afford before you apply for any type of credit helps you keep ahead of your finances. There is a range of online tools you can use to help you find out what your borrowing power is and how a credit card or one of our instant loans will affect your general living expenses and monthly cash flow.

To be eligible to apply for our credit card application online or any credit product from MoneyMe, you need to be at least 18 years of age, currently employed and a permanent resident in Australia. We check your credit file as standard when you apply with us but don’t worry if your credit history isn’t quite as good as you’d like it to be. We understand that a credit file is only one piece of the puzzle when we assess your application and recent changes to the way credit files record information mean that we see the past 24 months of transaction history now too. We can see what steps you have taken to correct any problems on your file and how well you’ve been doing.

Ready to apply for our low rate credit card? Get started now and complete and submit your application in just minutes online.