When you’re searching for great offers and deals for a new credit card, consider more than just cashback credit cards and compare all of the benefits. MoneyMe offers customers interest-free terms, a fast and easy credit card application online and ongoing rewards. Applications for our credit products take you just 5 minutes to complete online – it’s so simple.

How does a cashback credit card work?

Cashback credit cards come in a variety of forms, but they’re basically credit options designed to reward credit customers who repay their credit card balance on time. At the end of every month, you’ll receive a minimum monthly repayment notice that tells you how much you must repay on your credit card. You can choose to repay more than the minimum amount and that’s where cashback offers come into their own. When you repay your used credit balance within an allotted time, you are rewarded with free cash to spend.

Are cashback credit cards worth it?

When you’re shopping for a new credit card, comparing benefits and features between cards and providers is a great way to find money-saving extras that add up in the long run. Cashback promotions are just one of the many valuable features to keep an eye out for. They work by rewarding credit customers for repaying their credit balance on time with free cash they can use at participating stores, including online shopping. Other perks and benefits to keep an eye out for include low interest rates and interest-free periods.

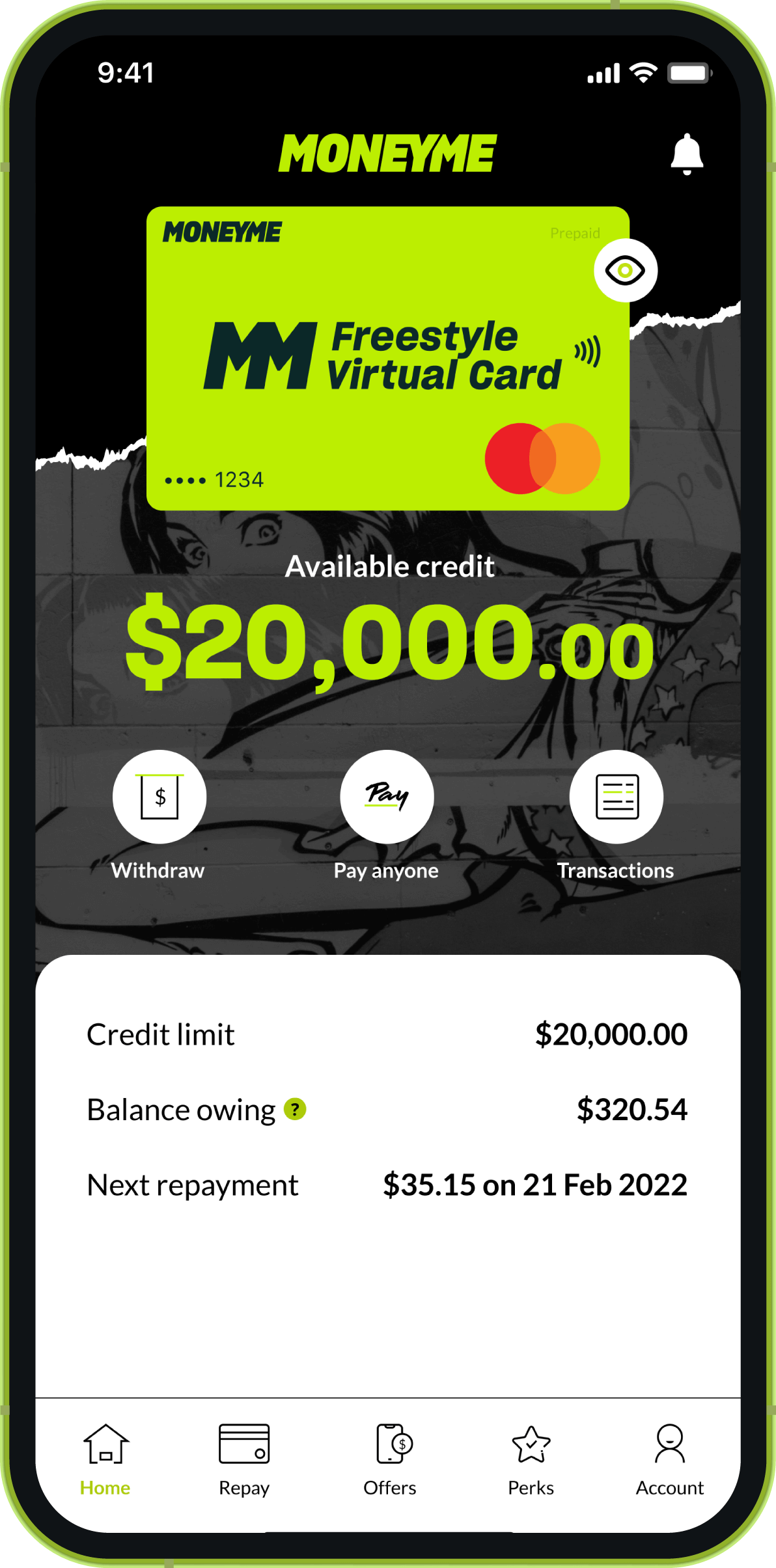

The credit market in Australia has blossomed under the advent of new buy now and pay later services and interest-free repayment periods. They look incredibly attractive, particularly for young people on a tight budget. They can be a great way of managing your money responsibly, so you can still buy all of the things you love immediately without the hefty cash loss in one go. Most buy now and pay later services offer you fortnightly repayment options that are directly debited from your account or your credit card over 42 days. This means that you’re getting 42 days of interest-free time to repay your debt. With the Freestyle virtual Mastercard®, however, we offer our customers an interest-free period of up to 55 days. This means that when you use your Freestyle account for purchases such as new clothes, groceries and your petrol costs, you get 55 days to repay your credit funds without being charged any interest. It basically means that when you repay that credit within 55 days, you’re actually using an interest free credit card and you’re getting almost an extra fortnight that popular buy now and pay later services offer you.

When you couple interest-free terms with cashback credit card offers, you’re really getting the most from your credit options. Not only are you avoiding costly interest on your credit, but you’re also getting free spending money to use at a variety of stores as well.

The Freestyle account with MoneyMe has even more to offer. You can transfer cash amounts from your credit account with us to your everyday banking account when you need a little quick cash loan to get you through until your next pay cycle. This might be because you had a bunch of unexpected costs coming up all at once or because you’ve been ill and couldn’t work on your normal shifts. Interest rates for cash transfers work differently to everyday purchases so if you need to call on this feature, it pays to know what your interest will be on cash transfers ahead of time. Knowing how much you can afford to repay when your pay cycle rolls around again can help you clear off your credit balance in one fell swoop and free up that credit again.

How to get a cashback credit card?

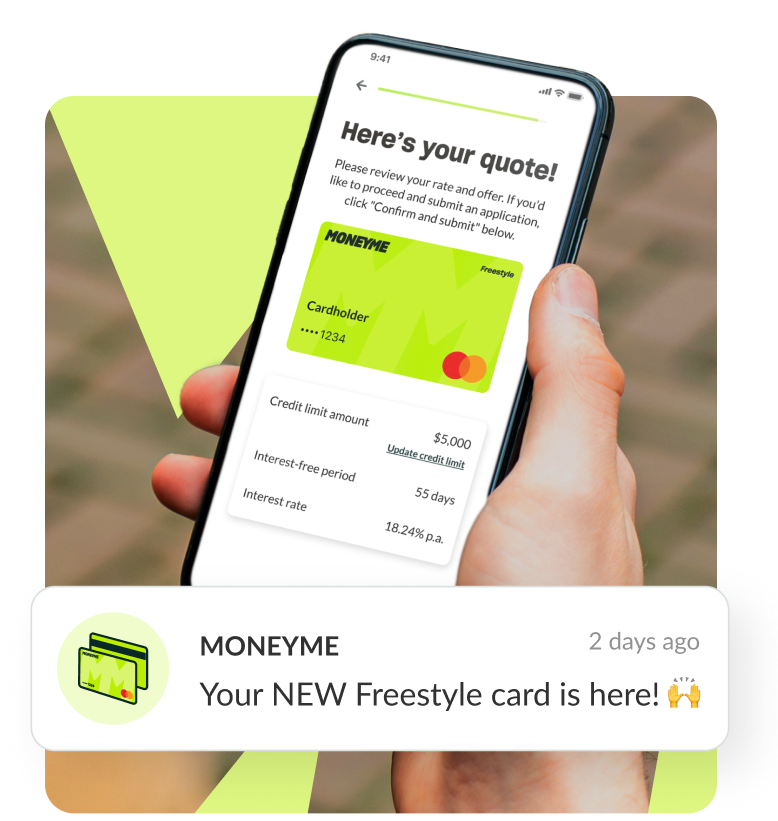

Getting a cashback credit card should be quick and easy. For example, we offer our customers a fast low doc personal loan and credit card application online. It takes you just 5 minutes to complete and submit your application with us and we don’t need lots of annoying paperwork. We are able to offer our customers a fast approval credit card because we ask you to input your online banking details at the end of your application. This gives your personal loan broker or credit card application assessor access to a read-only, 90-day bank statement from your normal account. We use this to quickly verify your application details like your salary and living expenses and then offer you instant credit card approval with a credit limit we think you can comfortably afford.

To be eligible to apply for any of our credit products, you must be 18 years of age, currently employed and an Australian permanent resident. If you’re a tech-savvy credit customer then you’re going to love MoneyMe. We have developed a no-bull, no-nonsense application and credit management processes that you can access from your smartphone. We send the majority of our communication via text and email so we’re not calling you and interrupting your life with a barrage of annoying messages you can read in your own time.

The Freestyle virtual credit card even lives on your smartphone rather than in your wallet. You can use it in-store wherever Tap n Pay is accepted and for quick and easy online shopping. We’ve thought of everything.

Ready to apply? Apply online now in just 5 minutes. Our fast approval credit card application can have an answer for you within the hour when you apply during our business hours.

Freestyle from MoneyMe works just like any other credit card option in that it’s a revolving line of credit available for balances between $1,000 and $20,000. When you use credit funds, they become unavailable. Once you repay those credit funds, they are freed up for use immediately. You can use your Freestyle Mastercard® for your monthly spending and expenses, such as entertainment costs on streaming services and concert tickets, as well your everyday needs like groceries, petrol, public transport, rideshare and more. Setting yourself a clear living expenses budget helps to keep your spending under control without denying yourself life’s little extras. When you repay your expenses within the 55-day interest-free period, you’re not paying interest on those costs at all.

If you find yourself regularly dipping into your Freestyle account for quick loans of cash, then it might be worth considering our range of personal loans. A fixed rate personal loan from MoneyMe gives you a lump sum cash amount that you’re free to disperse as you need it. You can get a loan to help you pay off some smaller debts, help you buy a car, cover your study costs, your medical bills – anything you need fast cash for. Repayments are set monthly amounts that are easy to budget around and you can clear out your loan balance at any time without worrying about paying early exit fees like some other money lenders charge.

There is no personal loan redraw facility available with our express loans so even after you have repaid some of your loan amount, you are not able to draw cash on that loan again. You can refinance a personal loan so you can cover off your existing balance and get some new funds if you need them.

Being a reliable and responsible credit customer with MoneyMe opens up new lower rates and fees for future credit with us. We reward our customers for being great with their credit so every successful finance loan or online credit card history with us gets you a higher credit rating and lower fees and charges.