Looking for great credit card benefits? How about a low doc personal loan and credit card application online completed and submitted in a matter of minutes? What about 55 days interest-free on purchases made? How about the ability to transfer yourself quick cash loans from your Freestyle account to your normal bank account, or someone else’s? These are just some of the credit card benefits we offer customers who have a Freestyle account with MoneyMe. The best part? Your Freestyle credit card lives in your smartphone and not your wallet, so you’ll always have it when you need it.

Shop online, in-store, pay for your cab ride or shout your friends to dinner. With MoneyMe’s Freestyle Virtual Mastercard®, you have a steady and reliable line of credit available when you need it and for what you need to pay, and great credit card benefits.

How to know your credit card benefits?

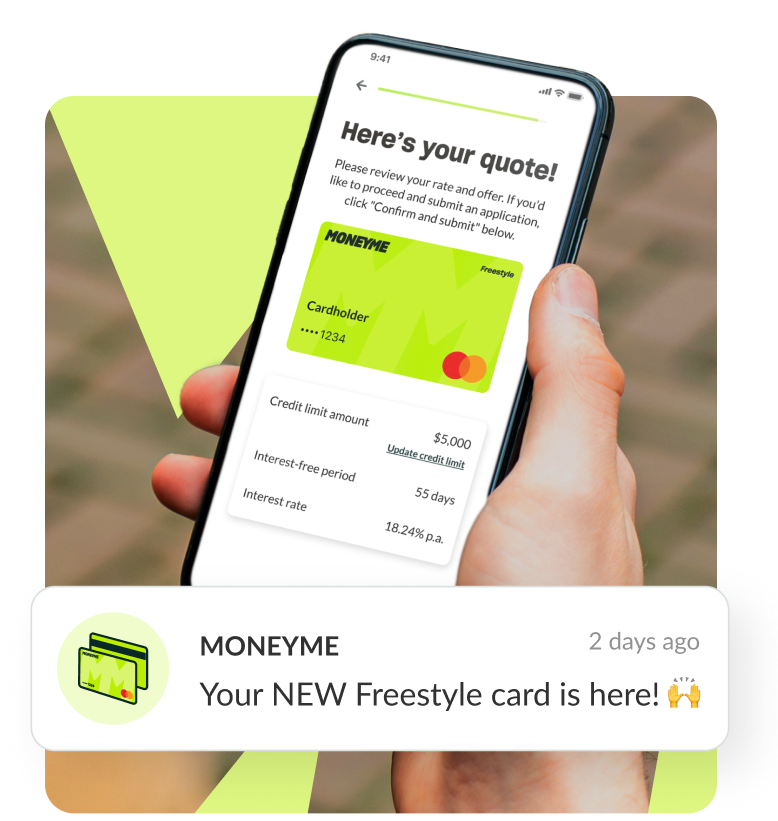

The credit card industry is highly competitive so if you’re considering a personal loan vs a credit card and what the best provider for you, then it’s not just a case of searching for a provider who offers the lowest interest rates. Other things to look out for include interest-free periods and low annual fees or monthly account fees. It’s also a great idea to take advantage of promotional offers like cashback rewards that tend to crop up from time to time. When you’re shopping for a fast approval credit card then take your time to find not only the best deal but also the best provider that you can.

How to use credit card benefits?

To get the most from your credit card, work out first what you need money for and how often you expect to use your new funds. If you’re searching for a quick loan to cover a big and one-time expense then you might find a fixed rate personal loan suits you better than a line of credit. Personal loans from MoneyMe are available for balances between $5000 and $50000 and come with fixed monthly repayments direct debited from your account for peace of mind. You can get small loans to help you with minor cash flow issues or choose a long term personal loan to help you with things like tuition costs, buying a new car or boat, financing home improvements or renovations.

If you’re looking for flexibility and the ability to redraw your credit once part or all of it has been repaid, then the revolving line of credit option definitely sounds like you. Our Freestyle account is powered by Mastercard and allows you to use as much of your pre-approved credit funds as you want and then repay it in your own time. You can choose to pay the minimum monthly repayment or up your payments to pay out your credit faster and chop down the interest that you pay. It’s your credit, your way.

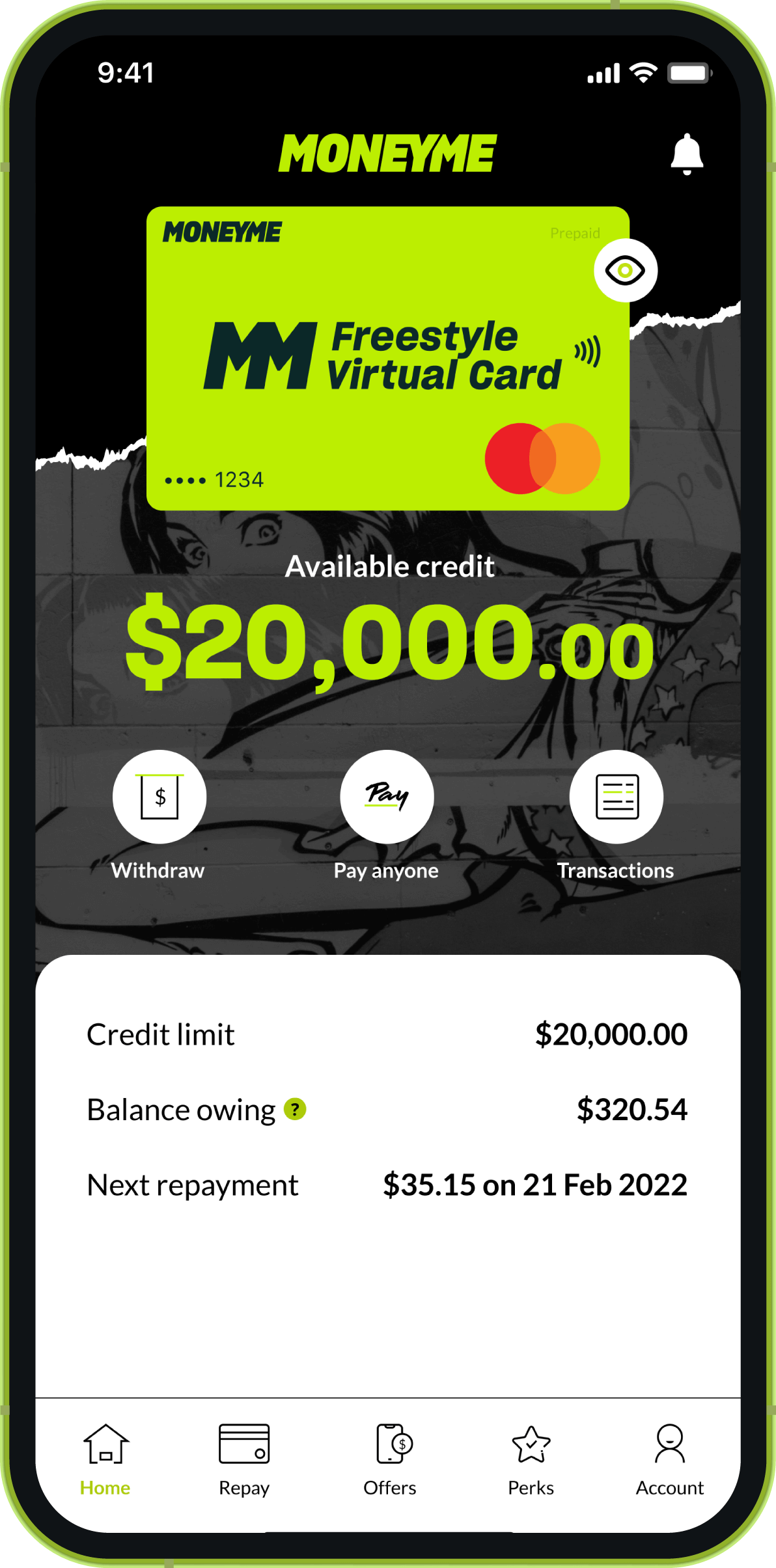

When you take out a quick cash loan there is no personal loan redraw facility available which means that even after you have repaid some of your loan amount, you don’t have the option to redraw credit from the loan for use in the future. If you do need to borrow money again then you’ll have to either refinance a personal loan (which means borrowing enough on a new loan to pay out the balance on your first loan) or apply for a second loan. Freestyle credit limits are available for between $1000 and $20000 so that gives you a lot of credit to play with over and over again.

When it comes to straight-up credit card benefits, let’s take a look at what we offer customers to give you an idea of what to look out for. For example, we offer customer 55 days interest-free on purchases made which means when you repay your credit balance within this period then what you basically have is an interest free credit card. It’s like buy now and pay later options but even better because not only do you not pay interest on purchases within 55 days, you can also transfer cash to your normal banking account, or anyone else’s. The Freestyle account from MoneyMe offers you flexibility and easy finance.

Your completely online application for our credit card can be completed in just minutes. That’s right. Just minutes to apply for the fast cash you need right now. You can use it for a quick cash advance to help you get from the pay cycle to pay cycle. You can transfer cash to your account, or use it to pay for big-ticket items and bills straight from the app. The idea is to keep your cash flow healthy and secure so you’re not wiping out your savings every time a life expense creeps out of nowhere. Our online application offers you instant credit card approval all online when you apply within our business hours.

How to get a credit card?

To qualify for our credit card or any of the MoneyMe credit products, you will need to be currently employed, an Australian permanent resident and to be at least 18 years of age. When you apply for an online credit card, you go through standard credit checks and evaluations. We look at your current living expenses, what sort of salary you have and any other debit cards or debts that you might have. If your credit file looks good and healthy then your internal MoneyMe credit score will be very high. If you’ve had some trouble in the past with credit, then you can still apply for our other loans products to help you rebuild your credit file. For every successful loan repaid, your credit score increases helping you with future credit applications. As a MoneyMe customer, you automatically qualify for our credit score privileges, with better perks the higher your rating is.

The Freestyle Virtual Mastercard® card comes with same day approval when you apply during our business hours, like our instant loans, and can be used for anything and everything from getting your groceries to paying the bond on a new rental property. Use Freestyle to help you pay for school supplies like university or college essentials. For whatever you need access to easy, simple and instant credit funds, your Freestyle Virtual Mastercard® is there to help out with great credit card benefits that reward you just for choosing Freestyle and MoneyMe.

Applications take just minutes to complete online and there is zero paperwork. When you apply for credit with MoneyMe, we verify your details by checking your online banking statement. This is the fastest and easiest way to verify salary amounts, living expenses and your current debts and commitments. It means that you qualify for instant credit card approval. With MoneyMe, everything is online and low doc. We even send you a credit contract online that you digitally sign.

Apply now and get the freedom and flexibility of doing it freestyle with MoneyMe. Access a range of credit card benefits from the Gen Now money lender with the smartphone credit card you’ll never leave home without.