Loans

Personal

loans for

kicking goals

Low rates starting from 9.19% p.a. (comparison rate from

10.58% p.a.)

with money in your bank account in as little as

60 minutes.

Won’t impact your credit score!

Won’t impact your credit score!

Estimate your repayments

Find out how much your repayments and interest rate could be with our calculator.

Estimated monthly repayments

$910.72

Example interest rate

9.19% p.a.

Comparison rate

10.58% p.a.

Total charges

$1,857.28

Total repayments

$21,857.28

It won’t affect your credit score!

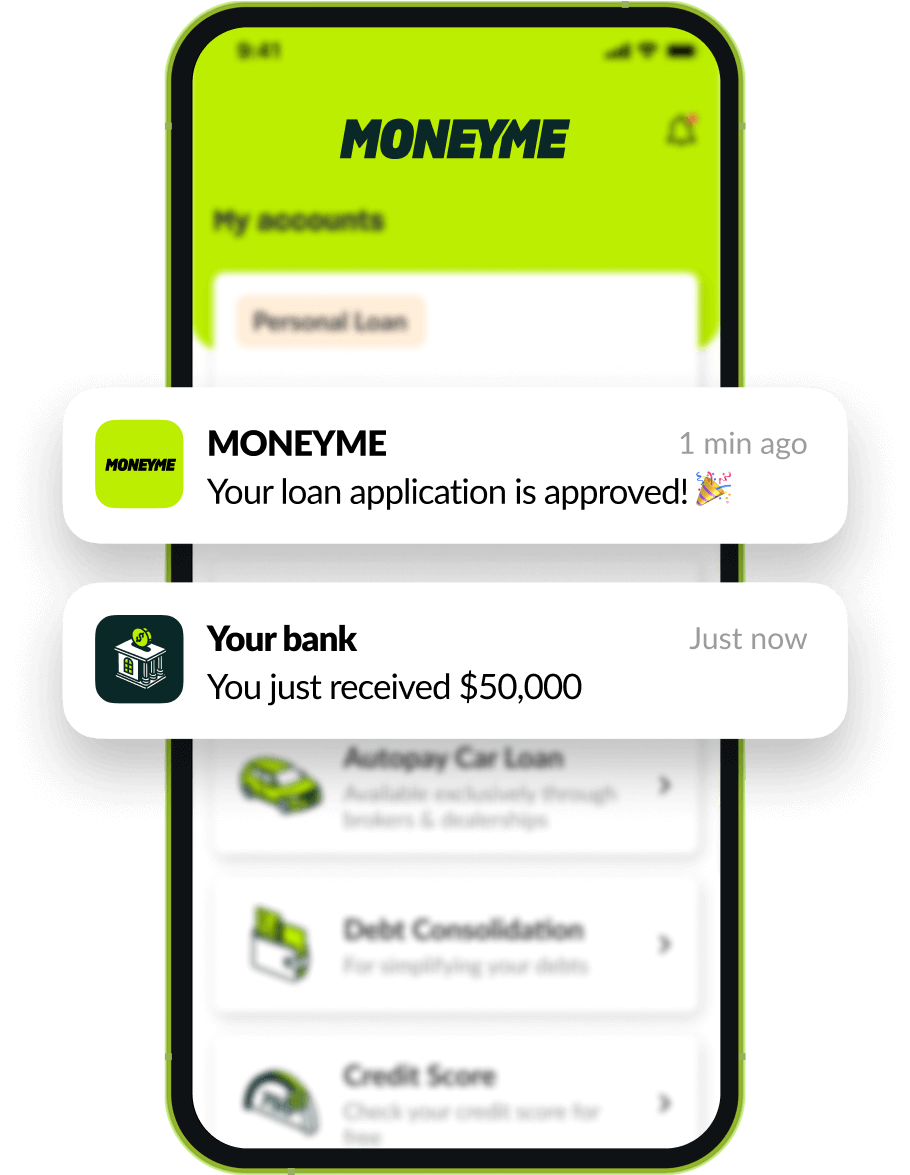

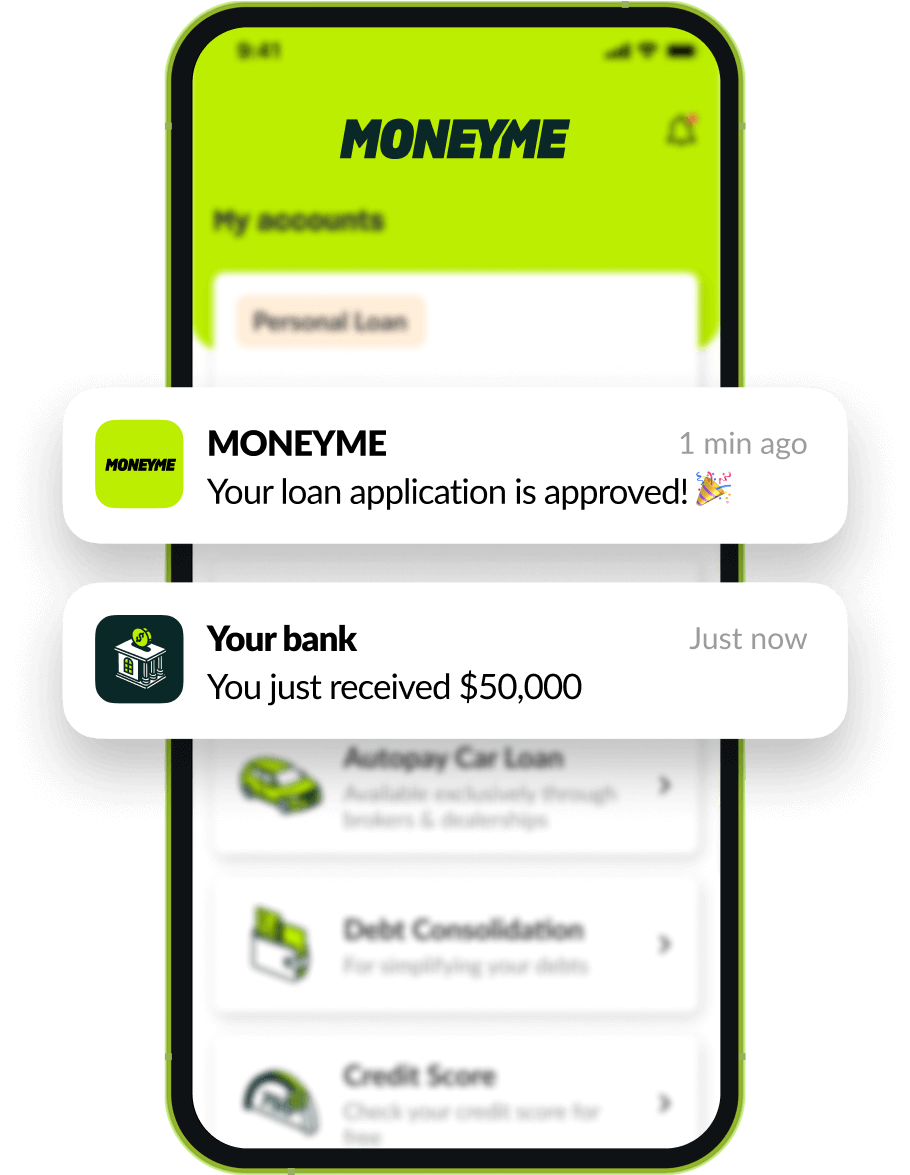

Loans up to $50,000 Approved Online

Loans for millennials, by millennials

Our application process is completely online and paperless for loans up to $50,000. You can apply for a loan in as little as 3 minutes and could have money in your bank account in just a few seconds, depending on who you bank with. We’re simple, fast and completely transparent.

Loans for millennials, by millennials

Our application process is completely online and paperless for loans up to $50,000. You can apply for a loan in as little as 3 minutes and could have money in your bank account in just a few seconds, depending on who you bank with. We’re simple, fast and completely transparent.

Welcome to the new generation of credit. Living in the twenty-first century is the best time to be alive. You have access to not only the bare essentials but to modern services that makes experiences faster and easier. Healthcare and fitness options are easy and accessible, and cross-training and career flexibility has never been this good. We want to travel; we want to professionally develop with college courses and university degrees. And not just experience one school of thought, but all of them.

You can cross hemispheres in less than a day, so why shouldn’t you have access to a personal loan in just a few minutes. With MoneyMe, you can. We offer fast cash loans from $5,000 to $50,000 which can be applied for using a quick online application. The process takes just a few minutes, and transfers for quick cash loans can take as little as seconds from the moment you sign the contract.

We believe in responsible lending and easy transactions – no paperwork or lengthy forms. Our loan application process uses machine learning and smart algorithms to do all the heavy lifting, meaning a fast and effortless experience for you. Simply find what you want, apply for the cash loan you need, and then you get it, fast.

Secured loans

When you apply with money lenders for any size loan, whether that’s small loans and short term loans, or larger loans like renovation loans, a student loan or car loans, the credit provider is going to want to know what kind of assets you own, what type of employment you have, how comfortably you can afford to repay the loan amount and whether you represent any risk for lending.

A secured loan is money borrowed that is backed by your personal assets, like a car or a property. This process of securing your personal loan helps to mitigate the risk assumed by the credit provider in the instance of you not repaying the loan, and therefore offers the credit provider a way of recouping any losses they incur in the event of a default. When you fail to make your repayments, it’s called a default.

MoneyMe makes informed lending decisions based your credit profile, bank statements, demographics and other factors that go into our machine learning and AI processes to ensure fairer, tailored outcomes. We don’t believe in quick judgments and we tailor our loans online for specific customers. It’s not a one-size-fits-all world so why should loans online or a line of credit work that way?

How secured loans work

For example, you applied for a $10,000 secured loan and have a car owned outright, worth about $8,000. Your credit provider will evaluate the risk of how likely you are to repay your loan based on the information drawn from your credit history and credit file, plus the worth of the asset you would like to secure your loan to. In their calculations, they will choose interest rates that reflect the level of risk they are assuming when they give you the money. The risk of your loan to a lender means loan offer might result in the amount requested or in some instances lower amounts. Given your credit history, they may offer you the $10,000 if you use your car as collateral. In some cases, they’ll need to reduce the loan offer if you don’t fit within their lending criteria and acceptable level of risk.

Unsecured loans

An unsecured loan is a loan that is offered based on your general daily expenses, employment income, savings and history with any credit options you have had. It may be that you’ve never had a bank loan or a credit card before, or you may have had some financial hurdles that required extra cash in hand. Here at MoneyMe, we use machine learning and AI to scan thousands of touch points, allowing our smart algorithms to provide fairer, tailored loans suited to your personal circumstances

We understand that sometimes life events just happen and when you’re trying to get on top of your finances, you need a little help.

Determining your rate

When we evaluate loan applications, we consider the whole picture. Changes to credit history information mean that lenders are now able to access a more comprehensive credit report. Unlike the old credit score model that would usually only include negative reporting, the new comprehensive report allows lenders to view positive credit behaviours. This will give you the opportunity to make your repayments on time and create a positive influence on your credit score.

How do you calculate loan repayments?

Understanding what fees and charges are involved with your loan, like an establishment fee or early termination fees, can be hard to get your head around. Here at MoneyMe, we don’t impose early exit fees for early repayments. You can pay out your loan in full before it’s due and we’ll be happy to close out your account ahead of schedule. When you’ve shown that you’re a low-risk credit customer who pays back what they owe regularly, or early, then you may be eligible for a better rate for your next credit product with us. We also don’t agree with hidden fees. We’re very transparent and explain everything we need from you before you sign a contract.

If you’re interested in knowing more about your repayment calculations, feel free to send us a message at hello@moneyme.com.au or you can give us a call on 1300 669 059. It’s also a good idea to consult MoneySmart, an Australian government website that helps people have access to relevant information and better manage their money. You can access budget calculators and a loan calculator to help you understand interest rates and how these affect your loan repayments.

Loans tailored to your financial needs

You can start your same day loan application online right now by completing our easy online form. When you apply online, we retrieve a read-only copy of the last 90 days of your bank statement using a secure and safe portal from our partner illion Open Data Solutions. Rest assured we do not store or have access to your banking details. They are protected by SSL encryption, the same encryption levels that your bank uses.

We can offer fast cash loans tailored to your financial circumstances. You can use our fixed-rate loans for a variety of purposes. Use it for purposes such as managing bills and debts, fast bond payments on a rental property, holiday and wedding deposits, or a quick cash advance while waiting for your next pay cycle. Our line of credit option acts like a virtual credit card and can be used for Tap n Pay in-store, online purchases and a redraw facility. With MoneyMe, we believe in easy money and you have the freedom to use it in any way you like.

We make it fast and simple to access personal loans when you need them. Start your application for loans online right now and get approved in minutes.

Manage your debts easily

Consolidation loans is a great way to manage your finances. It helps you simplify a large amount of loans by generating a fixed interest rate repayment schedule that will assist to move you out of unmanageable debt and into a much more stable credit. When you choose a consolidation loan to refinance, your prospective lender will look at how much you earn, what your living expenses are, and what your financial commitments are to multiple providers.

Generally speaking, when you consolidate your debts you end up paying less in repayments for a single loan than you would trying to pay off your other credit separately, as you swap multiple loans with higher interest rates with one loan with a better rate.

With MoneyMe, you can access personal loans online for consolidating your debt. And because we love rewarding our good customers, you may be eligible for an even cheaper interest rate on new loan offers if our system reflects a positive repayment history under your account.

Get cash today. Fast and simple loans online with no paperwork

There are times when quick and easy access to cash is really handy, especially for the purchase you just can’t wait for or perhaps you have an unexpected expense that just needs to be paid for.

Whatever your aspirations are, with MoneyMe you can apply for a cash loan online for any amount ranging from $5,000 up to $50,000.

With our fast online approval, you could get a cash loan today; then repay it according to your usual pay cycle. There are no sneaky hidden fees.

And if you need another online loan down the track, you can apply for a new one as soon as your current loan is paid off.

Easy online application

Applying for loans online is safe and simple- without the hassle of sending us paperwork like bank statements or payslips. This way we can give you a speedy response regarding your loan application.

To be eligible to apply you must be working in Australia and 18 years or older. Just so you know, we’re a responsible lender– we won’t lend you more money than we think you’re able to comfortably repay.

Our customers

LOVE us

Loans

Jayceenemo

Aug 09, 2023

Aug 09, 2023

Fast, fair and easy. Very happy customer. Happy to get another loan in the future from MONEYME.

BGC

Jun 13, 2023

Jun 13, 2023

Simple process, easy to follow application, quick response time and good support.

Brad

May 31, 2023

May 31, 2023

I was impressed with how easy and quick the application was. Very happy with their customer service, and the app is very convenient.

4.6/5

Transparent and

simple pricing

Interest rate

(variable)

9.19

%

p.a.

to 23.99

%

p.a.

Comparison rate

10.58

%

p.a.

to 26.58

%

p.a.

Establishment fee

(Direct applications)

$395 for loans between $5,000 and $15,000

$495 for loans between $15,001 and $50,000

Monthly fee

$10

Loan terms

Minimum 3 years

Maximum 5 years

Early exit fees

None

Ready to get

started?

Won’t impact your credit score!

Won’t impact your credit score!