For anyone looking for a great credit card deal, you can’t go past the Freestyle virtual credit card. While you’re searching for a credit card sign up bonus or other hot offers, ensure you take some time to review our low rate and low fee offer with the flexible Freestyle account, made for tech-savvy credit customers just like you. Applications take you just minutes to complete and submit – and it all happens online.

When you choose MoneyMe and either our suite of personal loans or our fast approval credit card, you’re choosing the tech-savvy money lender who has tailored both their credit card application online and their low doc personal loan application to people just like you.

What is a sign up bonus on a credit card?

A credit card sign up bonus is usually a promotional item a credit provider will offer for new customers who sign up for either their line of credit option or their personal loans. If you’re hunting for a new credit card – or you are brand new to the credit market – then doing your homework can help you to find great deals offered by Australian money lenders that not only instantly reward you for choosing credit but also help to save you money over the longer term.

A sign up bonus is normally an introductory offer so if you’re considering a money lender who’s offering a great looking promotion then consider carefully how long that promotion lasts, what it offers you compared to long term use of their credit products and what kind of money you’ll save (if any). Taking advantage of introductory offers is great but to ensure you’re getting bang for your buck, take a look at the terms and conditions carefully once the bonus period has ended.

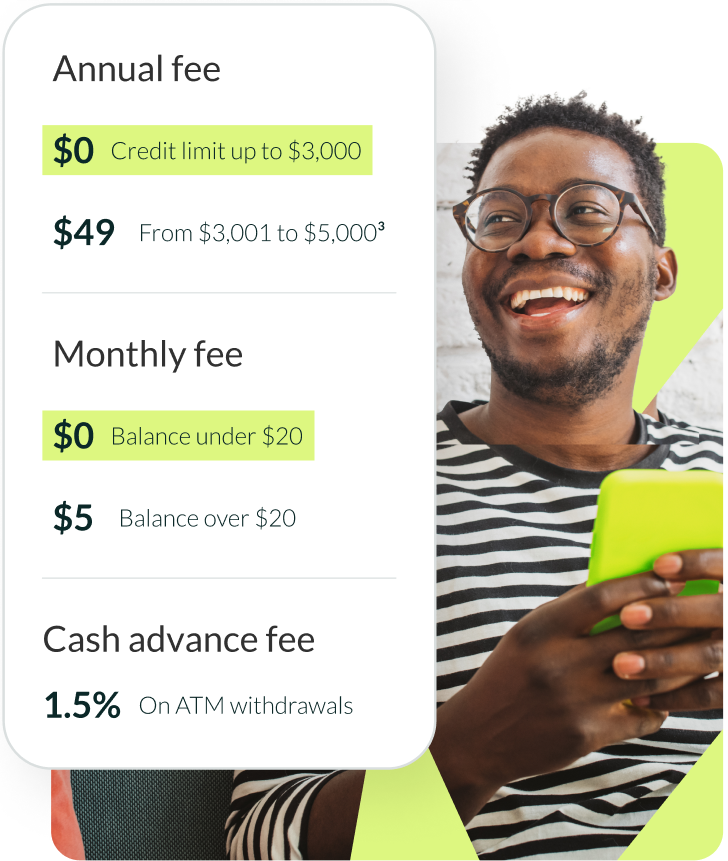

Things to consider for long term use of a new credit product include any interest-free periods your new credit provider has to offer, what the monthly and annual fees are and whether you can save on fees, what kind of application process they are offering and how quickly you can get access to your new funds.

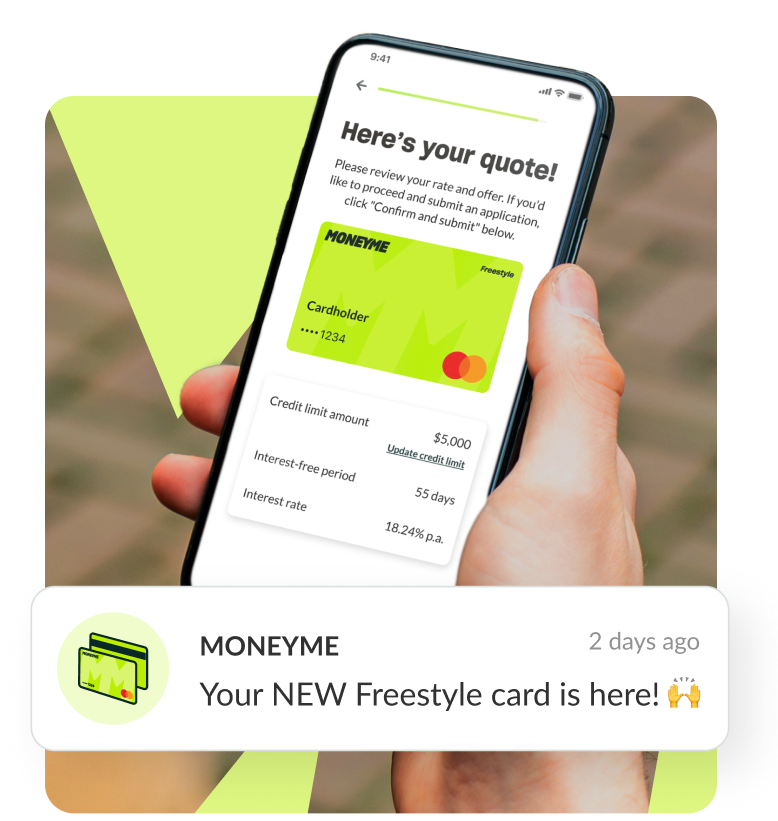

We specialise in offering fast cash and easy finance options at the click of a button. As a wholly online lender, we don’t have a physical branch office and we have harnessed the power of the internet to produce a fast, easy and intuitive application and credit management process. Our application form takes you just minutes to complete and submit, all online. We likely won’t even need to call you and we definitely won’t need to confirm your working arrangement with your employer. Instead, when you have completed our online application form you’ll be directed to a screen that asks you to input your online banking credentials. Don’t panic when you get to this screen because it doesn’t actually give your personal loan broker or our assessment team access to your online bank platform. We don’t even get your login details. Instead, we get a PDF format (read only) 90 day bank statement showing your most recent transactions. We use this to verify things like your living expenses, your salary and any other repayments that you’re currently making. It’s this fast and intuitive application process that allows us to offer instant approval credit cards and same day loans.

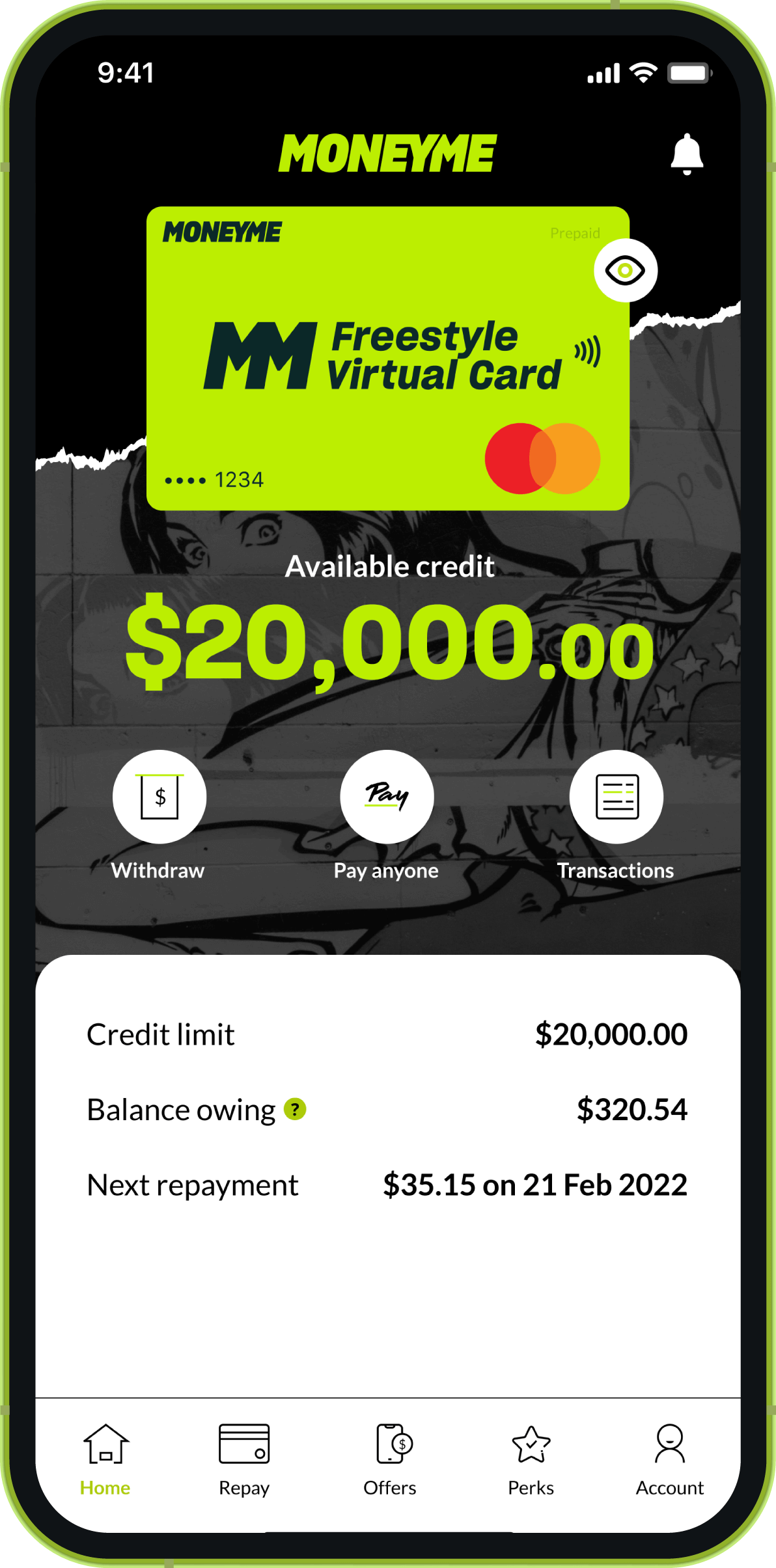

When we have verified your details (which typically takes about an hour when you apply during our business hours) we send you a credit offer. This will be for either our Freestyle online credit card or for any of our easy loans that you have applied for. Everything you need to know about your new credit product is included so you can check things like your interest rate, how many repayments you need to make, what your credit limit or approved personal loan balance is and any fees and charges associated with your chosen product.

When you choose the Freestyle Mastercard from MoneyMe you receive low annual and monthly rates, low interest rates and up to 55 days interest-free. This isn’t just a credit card sign up bonus, this is for keeps. Your monthly fees, for example, can be waived entirely if your credit balance is below $20 at the end of the month. When it comes to interest-free buying, you’re covered there too. Most popular buy now and pay later options advertise 4 interest-free fortnightly repayments. When you break this down it equates to 42 days interest-free and you’re limited to which shops will accept their program, how much you can spend and how many concurrent purchases you have at any one time.

Freestyle is different. Not only do you get an additional 13 days of interest-free time in which to repay your purchase amount, but our credit card is also powered by Mastercard which means it is accepted nearly everywhere. There are no minimum purchase amounts either. When you repay your purchases within this period you are essentially using an interest-free credit card.

How do I get a credit card signup bonus?

Getting access to a special credit card sign up bonus is usually taken care of once you’re approved for your chosen credit product. Credit providers will apply your discount, your special rate or your cash back offer at the time of you signing up. To make sure you’re getting the best deal, check your credit contract when it arrives first and contact your new credit provider if anything seems unclear.

MoneyMe offers instant credit card approval and we’re not a needy money lender and most of our communication will come to via email or text. If you need to clarify anything you have seen on our website, then you can live chat with an agent directly through our website or you can call or email us. Our business hours are 8 am to 9 am Monday to Friday and 9 am to 9 pm Saturday to Sunday. You can call us directly on 1300 669 059.

How can I spend my credit card bonus?

If your credit card sign up bonus comes in the form of a cash back offer then this is usually reserved for spending at a variety of specially chosen stores. This will be credited back to your account for you to use when you need to. You should receive the full terms and conditions of your sign up bonus when you receive your credit contract. At MoneyMe we want to ensure that our customers get the right information as easily as possible so everything you need to know about our special offers, our regular charges and fees and anything else relating to our credit products is available to view on our website in plain speaking language.

Ready to get started? Apply online now for the Freestyle Mastercard or any of our instant loans via our website. Applications take only a matter of minutes to complete and submit and approvals are usually instant. Once approved and everything has been signed, your Freestyle account is instantly available. If you’re applying for any our quick cash loans then you could have the funds you need the very same day you apply for them, depending on who you bank with.

Don’t delay apply now with MoneyMe to see how much you could be approved for today.